We are Not All the Same! Who Really are My Family Owners?

By Rodrigo Basco, Ph.D., Professor at the American University of Sharjah, United Arab Emirates

2025-2026 FOBI Scholar in Residence

Some business families split their empires or lose everything when differences among owners generate conflicts. Others use the owners’ differences toward growth and staying united.

The prominent cases of businesses splitting up are the Ambani brothers in India, who split one of the biggest conglomerates after their father’s death, and Germany’s Oetker Group, which divided its global empire in 2021 over family disagreements. However, not all owner differences end in separation; in some cases, they become a source of unity. For instance, the Hermès family was able to neutralize a hostile takeover by Moët Hennessy Louis Vuitton (LVMH) by setting up a private holding company, which owns 50.2 percent of Hermès shares, unifying the family voice and vote to secure control.

Why then are some families able to turn ownership into unity, while others get into conflict?

Let us begin by breaking the myth that family members — because they share history, values, and bonds — always think alike as owners. The belief is culturally rooted in the idea that family members love and care for each other, and have mutual respect, and hence, stay united for their business. This assumption emanates from a belief that family is a place of protection, care, and unconditional support. However, reality is often different. Each family member has specific roles, needs, goals, and expectations that naturally change over time and across contexts. This heterogeneity among family members is precisely what makes the management of family businesses unique.

Consequently, the relationships between family members and ownership do not align naturally. Each person develops a unique psychological relationship with their share. The ownership of the family firm is not just about financial value but also carries meaning related to belonging and identity, power and position, and social recognition, among others. When family members assume their roles as shareholders, debating strategies, dividends, reinvestments, and philanthropy, they are not only negotiating financial matters but also important intangibles such as recognition, influence, legitimacy, and fairness.

If business families recognize that family members relate differently to ownership, they can design ownership strategies that respect individual interests while cultivating unity, by serving collective needs. However, awareness alone is not enough; turning diversity into actionable agreements and constructive conversations remains a major challenge.

To make sense of the different ways in which family members relate to ownership, I have developed a classification that groups family owners in terms of their intentions and motivations for ownership (Basco, 2025).[1]

The motivational state explains how family owners pursue ownership goals. Some family owners prioritize investment, expansion, and wealth accumulation, whereas others prefer stability, conservative strategies, and risk avoidance. In this sense, owners relate to ownership on a spectrum between two extremes: wealth harvesting and wealth creation.

By contrast, the intentional state explains what owners want from holding shares in their family firms. For some, ownership serves to achieve personal goals, such as control, financial returns, and influence or power. For others, ownership reflects a commitment to collective family goals such as family unity, harmony, and preserving the family legacy across generations.

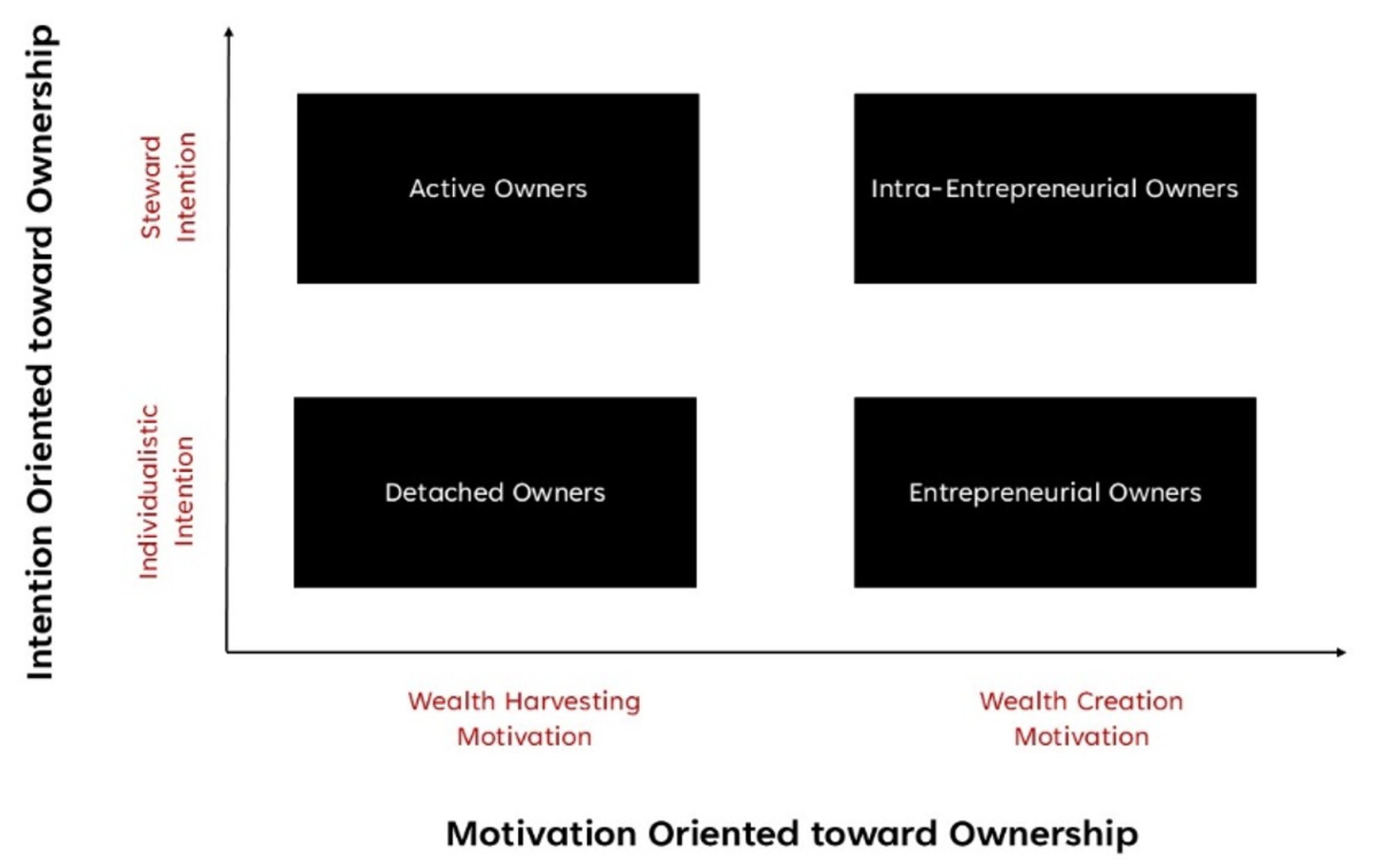

When we combine motivation and intention, four types of owner styles emerge (Figure 1):

- Active Owners are stewards who value stability, unity, and protection of assets and reputation. They understand their role as guardians in preserving wealth and traditions with the purpose of continuing the business across generations.

- Intra-Entrepreneurial Owners are growth-minded stewards who reinvest, innovate, and expand. They balance respect for legacy with the drive to create new wealth for future generations.

- Detached Owners are passive investors who hold shares mainly for personal financial gains. Their connections to the family and its legacy are limited, and they focus on the returns of their share.

- Entrepreneurial Owners are ambitious innovators who view ownership as a platform for growth, autonomy, and independence by looking for new opportunities outside the family firm. They focus on pushing boundaries and prioritizing their personal vision over family goals.

Figure 1: Types of Family Owner Styles in Businesses

Description: The chart shows a two-by-two matrix that groups family business owners based on what drives them and what they aim to achieve as owners. The horizontal axis moves from a focus on harvesting wealth to creating new wealth, while the vertical axis moves from individualistic goals to a steward mindset. In this layout, Active Owners are in the top-left, Intra-Entrepreneurial Owners in the top-right, Detached Owners in the bottom-left, and Entrepreneurial Owners in the bottom-right. The visual instrument helps describe how different combinations of motivations and intentions shape four distinct owner profiles.

Source: Basco, R. (2025). Not all family owners are alike: A conceptual model, measurement instrument, and self-assessment application for identifying family owner styles. European Journal of Family Business, 16(1), 107-120. doi:10.24310/ejfb.15.1.2025.21758.

Understanding these four ownership styles helps business families recognize not just who owns what shares but how each owner’s mindset shapes the future of both the family and business.

What type of family owner are you—and what does that mean for your business?

I have developed a free-access self-assessment tool available at https://familyinbusiness.education/dashboard#ownership.[2] By answering a few short questions, you can discover your ownership style and how it relates to your family’s business share.

The self-assessment tool is designed for practical use. For individual family members (owners or future owners), it offers a way to step back and ask, “What kind of owner am I, and what do I want from this family business?” This reflection is especially useful for the next generation as they define their place in the firm. For families (groups of individuals), the tool reflects the quadrant to which each member belongs, demonstrating the ownership logic of current and future owners. It is a valuable tool that can be used to initiate constructive conversations, helping the family reflect on how it stands vis-à-vis the ownership. Advisors and consultants can also apply it in their practice to identify ownership patterns, anticipate points of tension, and tailor their guidance. In the field of education, it provides a hands-on learning experience that explains ownership dynamics based on the diversity of owners, which offers concrete understanding for students and executives alike.

It is important to understand how family owners relate to family business ownership because their intentions and motivations shape their behavior, position, and decision-making in ownership meetings. Different styles influence how they approach key topics such as dividend distribution, reinvestment policies, ownership structure for future generations, mergers and acquisitions, and succession planning. The ownership style affects both family unity and business success.

Notes

[1]In the academic article published in the European Journal of Family Business, I have provided the scientific explanation and methodical approach used to test this model of family owner style.

[2]Upon completing the assessment, respondents receive their individual results, which includes their family ownership style, a summary of the model from a practical perspective, and a short explanatory video of the framework.

Reference

Basco, R. (2025). Not all family owners are alike: A conceptual model, measurement instrument, and self-assessment application for identifying family owner styles. European Journal of Family Business, 16(1), 107-120. doi:10.24310/ejfb.15.1.2025.21758.