Angel Networks in West Michigan

By Joerg Picard, Ph.D., Associate Professor, Department of Finance

Note: An Angel is a high net-worth individual that invests in start-up companies.

Our West Michigan region is fortunate to feature a thriving infrastructure for entrepreneurs and the start-up scene. Academia (UofM, MSU, GVSU, WMU) and medical companies and organizations (Pfizer, Stryker, DuPont, Grand Rapids medical mile) engage in fundamental research and develop technology that local entrepreneurs convert into start-up businesses that provide meaningful and high-paying employment in West Michigan. These start-up investments need significant amounts of funding, management coaching, and general means of networking opportunities with potential customers, vendors, legal and accounting services, etc., which is provided by Venture Capital and Angel investors. The Michigan Capital Network[1] has its roots in Grand Rapids, when in 2004 a handful of successful business owners and executives founded the “Grand Angels.” Over the years, angel networks in and around Kalamazoo, Detroit, Traverse City, and Midland have combined their resources and invested over $50 million dollars[2] directly in over 50 start-ups. In addition to direct investments in these start-ups, many angel investors invest indirectly through any of the five venture capital funds that are professionally managed by Michigan Capital Network. These five funds have committed capital of over $150 million.

Contrary to what “Shark Tank” leads us to believe, angel investors do not form investment decisions within a couple of minutes after having witnessed one pitch from the entrepreneur. Angel investors go through a due diligence process that involves meetings with the entrepreneur and industry experts, market and product analyses, and the discussion with other angel investors. The technology and market of each start-up are complex, and the investment funds needed for each start-up company usually exceeds what a single angel investor is capable of or willing to finance. Therefore, angels combine their resources during the due diligence process and then collectively raise the funds through a legal structure called an SPE (special purpose entity). In-person meetings among angel investors, venture fund managers, and entrepreneurs are still an important channel of communication and they explain the geographic clustering of angel investors.

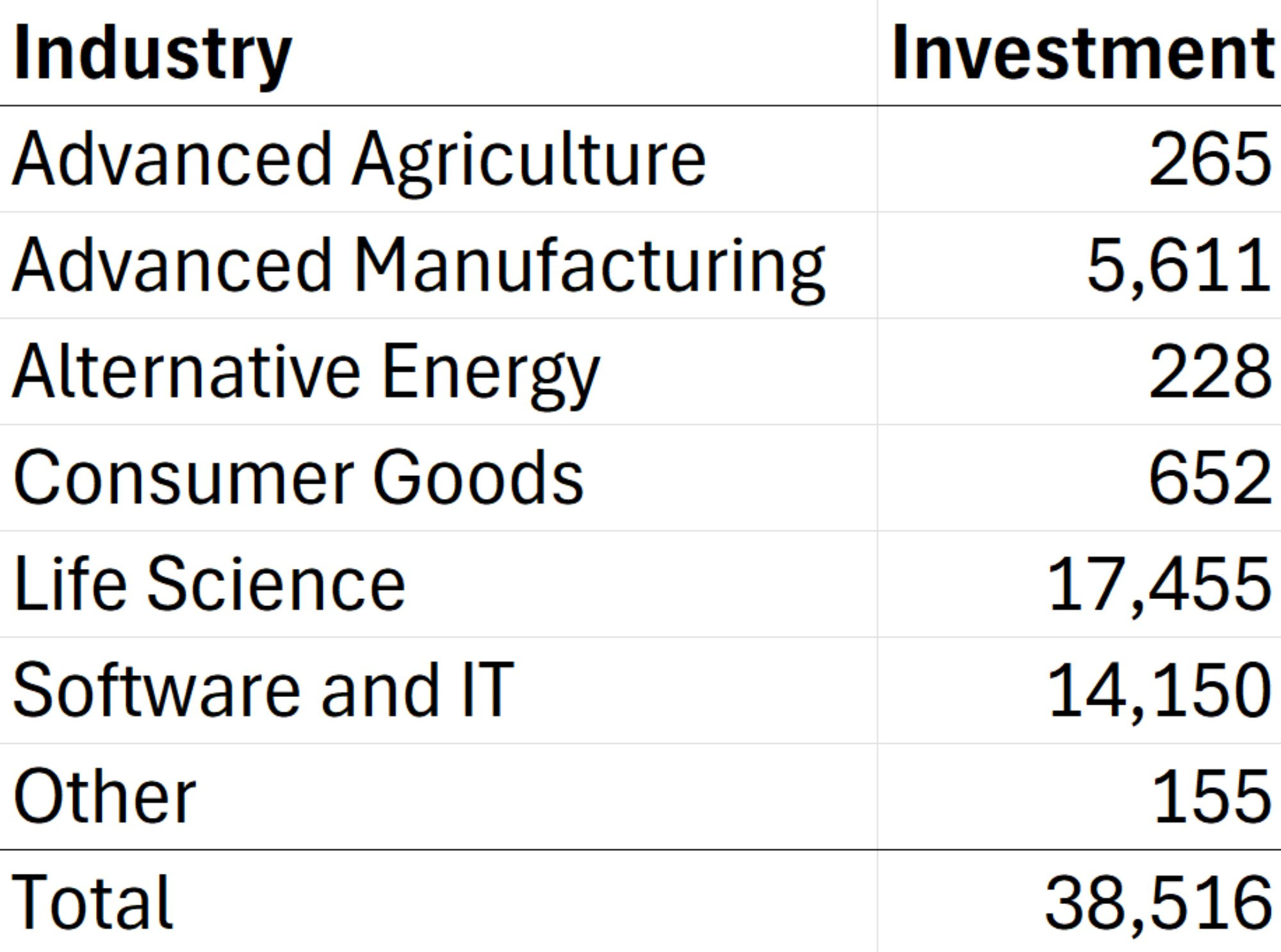

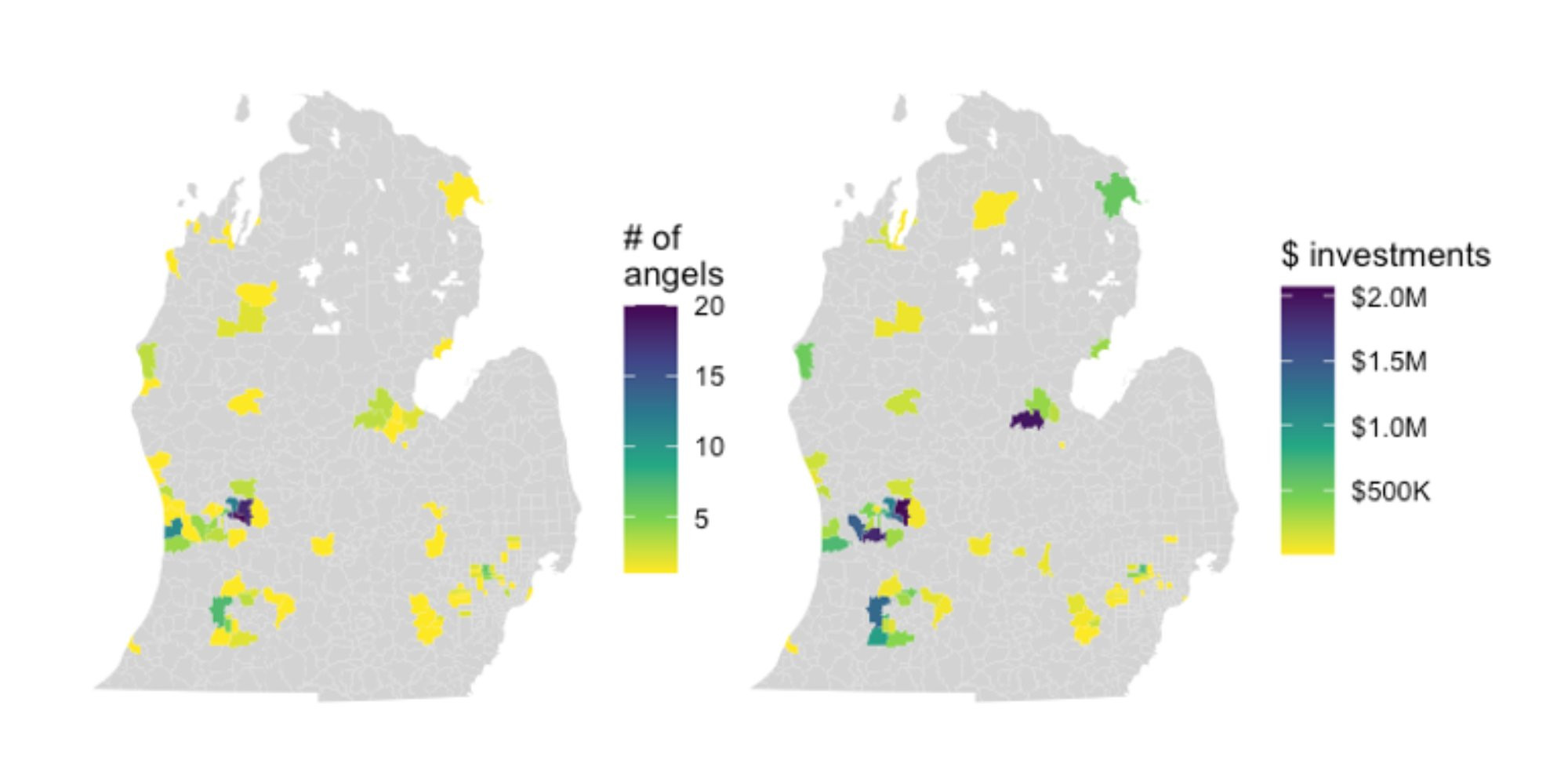

Figure 1: Heatmap of Angel Investors and Investment Dollars by ZIP Code of Residence

Description: Number of Angel investors in each lower Michigan ZIP code (left) and million dollars invested (right) between January 2013 and October 2024. Only includes direct investments, not including venture capital fund investments.

Source: Michigan Capital Network and U.S. Census Bureau

The largest concentration of angel investors and their investment dollars are in Grand Rapids, followed by Kalamazoo and Holland. It’s interesting to note the high amount of dollar investments in and around Midland and Alpena with a relatively modest number of investors living there. It is also a little surprising, how little angel activity is centered around Detroit, although there are other angel groups in the area outside of the Michigan Capital Network that are not part of this dataset.

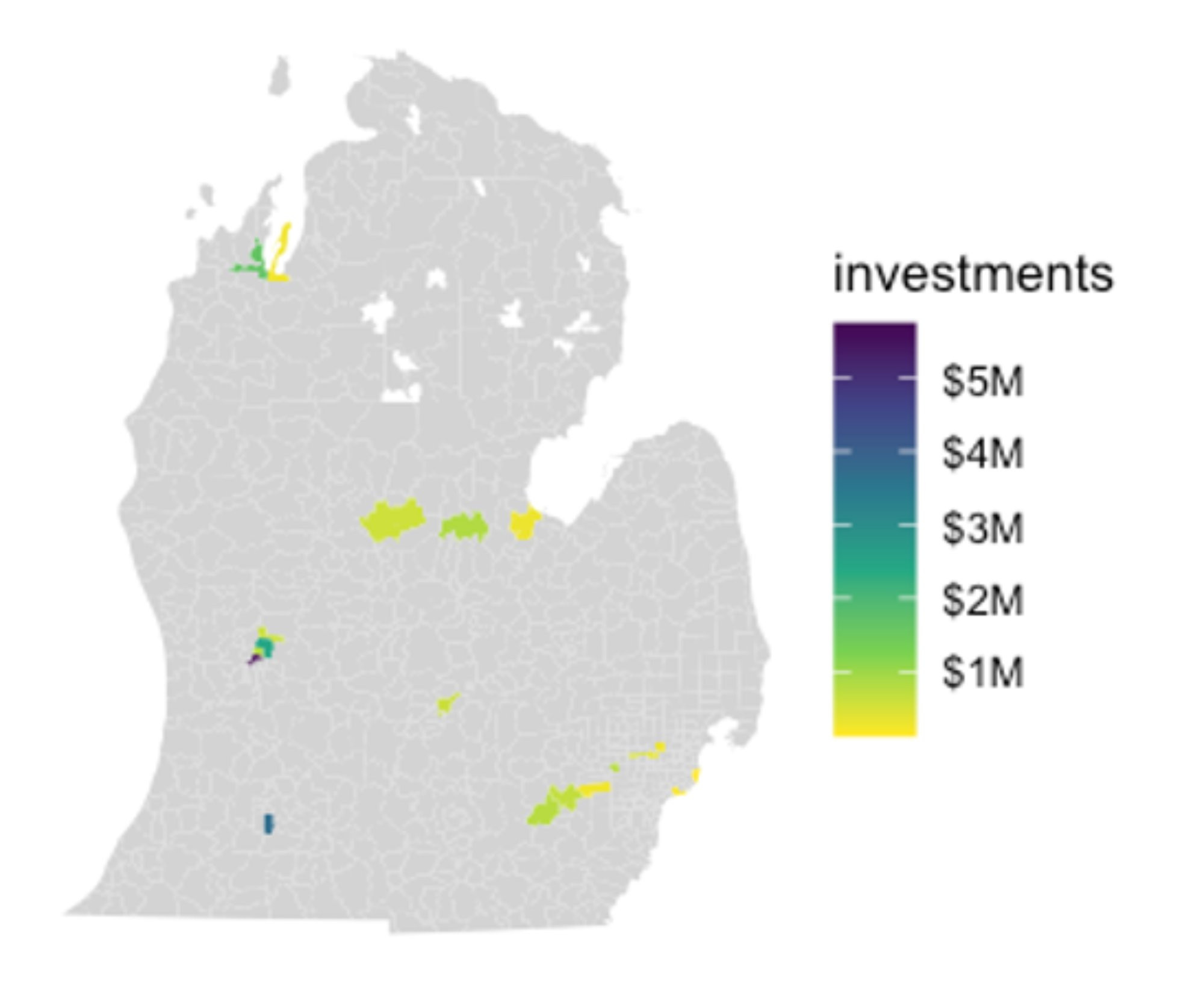

After knowing the geographic distribution of Michigan angel investor funding, it is also interesting to see where these investments are deployed.

The heavy concentration of dollars invested in start-ups is even more striking than the concentration of the sources of these investment dollars. Most dollars are deployed in the Kalamazoo and Grand Rapids areas. Recall from Table 1, life sciences is the top dollar receiving industry, and because of the existing infrastructure (Grand Rapids Medical Mile as well as Pfizer and Stryker in Kalamazoo) these two areas receive the most investment dollars.

In summary, even in today’s world of shortening distances because of technology and video conferences, geographic proximity is an important conduit of information in the world of start-up investing

Notes

[1] http://www.michigancapitalnetwork.com/

[2] This value does not match the total value in Table 1 since the data for Table 1 with ZIP code level detail is only available for the period after January 2013.