Economic Impact Potential and Characterization of Municipal Solid Waste in Michigan

By Christopher John Cruz, Ph.D., Assistant Professor, Department of Economics

Paul Isely, Ph.D., Associate Dean, Seidman College of Business

Aaron Lowen, Ph.D., Associate Vice President for Academic Affairs

Daniel Schoonmaker, Executive Director, Michigan Sustainable Business Forum

Carrie Veldman, Membership Manager, Michigan Sustainable Business Forum

Hayden Strabel, Student Research Assistant

NOTE: This is an abridged version of the full report with the same title.

In 2016, Michigan Sustainable Business Forum (MiSBF) and its member collaborators, including the Seidman College of Business at Grand Valley State University (GVSU), worked to characterize the economic and environmental opportunities available through sustainable materials management in Michigan. The project created an important tool for the advancement of recycling, composting, and the creation of a circular economy in the state. The resulting report, Economic Impact Potential and Characterization of Municipal Solid Waste in Michigan, has been regularly cited by state and regional programs since its publication.

Much has changed since 2016. While Michigan was then in the beginning years of a goal to double the state’s recycling rate, today it is deeply invested in an economy-wide effort to achieve a 45 percent recycling rate as part of the MI Healthy Climate Plan. International trade, transportation costs, infrastructure gaps and volatile end markets have created systemic challenges for the processing of certain materials, while accelerating or emerging end markets have created a growing need for other materials currently being sent to Michigan landfills. There are now local, state, and national programs working to create a circular economy to meet these challenges and opportunities, led by the Michigan Department of Environment, Great Lakes and Energy and supported by the $15 million Renew Michigan Fund and other initiatives.

Against this backdrop, MiSBF decided to update the 2016 report with the support of GVSU and other partner collaborators. The 2024 Michigan Municipal Solid Waste (MSW) Characterization and Valuation Study performed waste sorts at sites across the state, and through this, provided an economic valuation for diversion in terms of real material value, job creation, and other positive economic and environmental impacts.

Data Collection

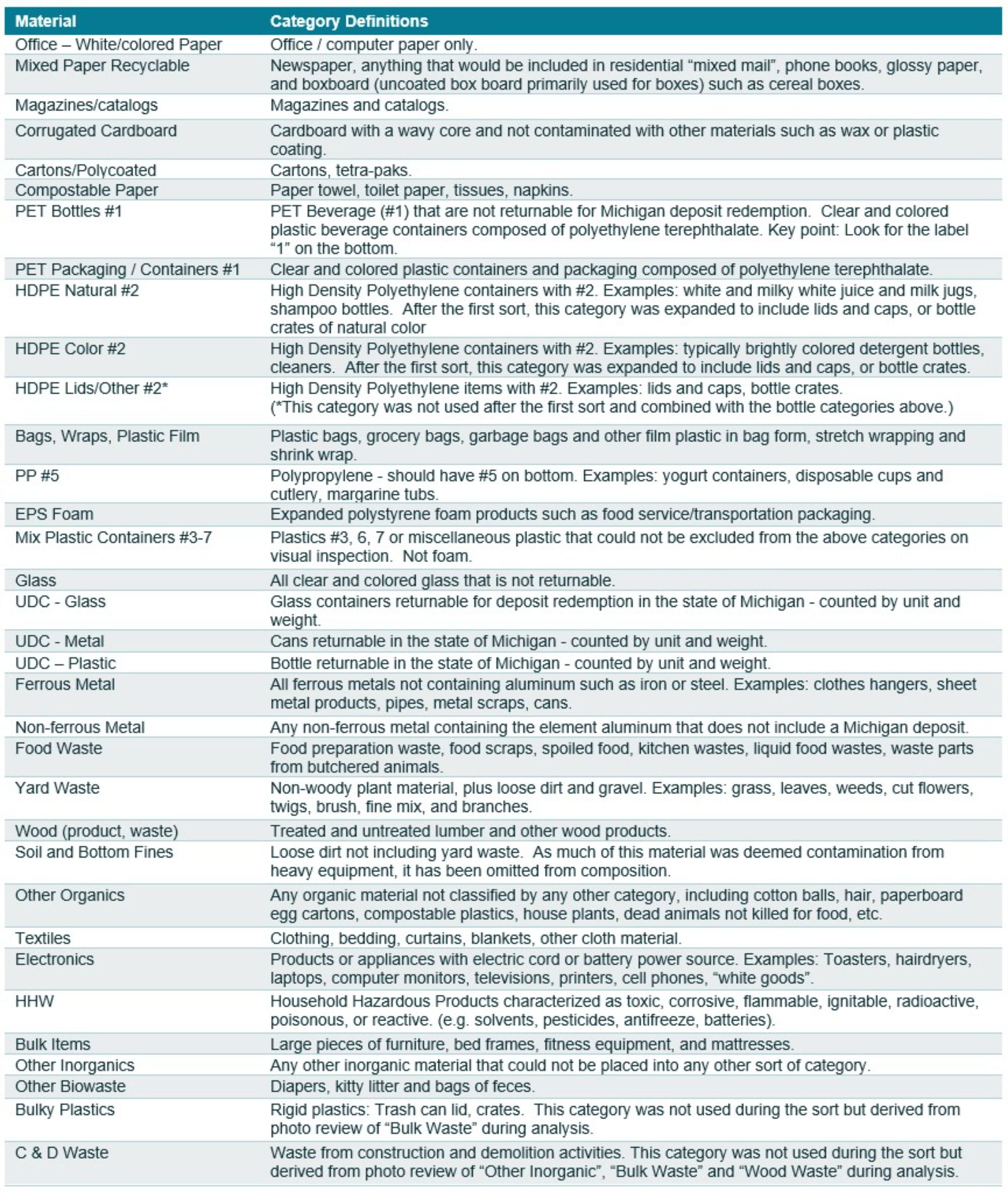

The first phase of the project was the characterization of municipal solid waste generated in Michigan in the summer of 2023. This involved the collection of 300-pound waste samples from 10 sites throughout Michigan, representing seven counties and five state planning regions. These were then sorted by hand into 32 categories. Table 1 depicts the schedule and quantities of mixed municipal solid waste sorted at each of the host sites.

Table 1: Waste Sort Location Information, Schedule and Weight

Description: Table 1 shows data including county of location, operator, whether it is urban/rural or a mix, date on which solid waste was sorted, and the sort weight for the samples used in this study.

Source: Michigan Municipal Solid Waste Characterization 2024 (Full Report)

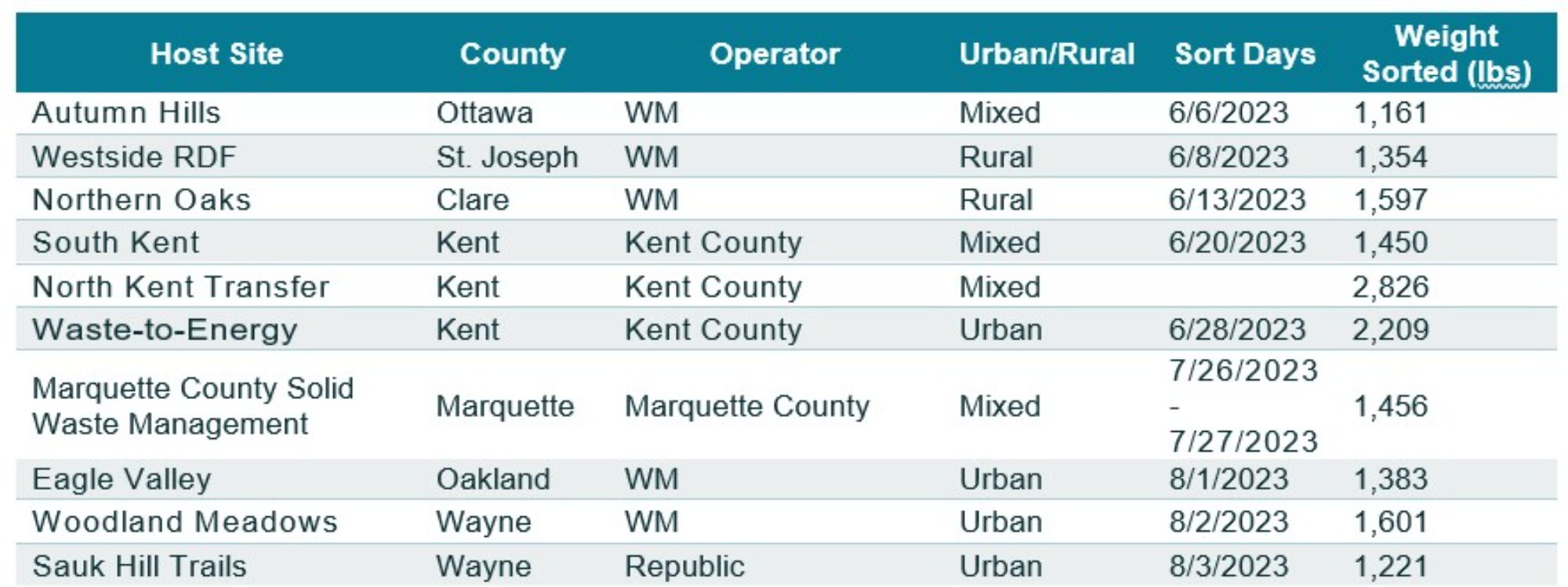

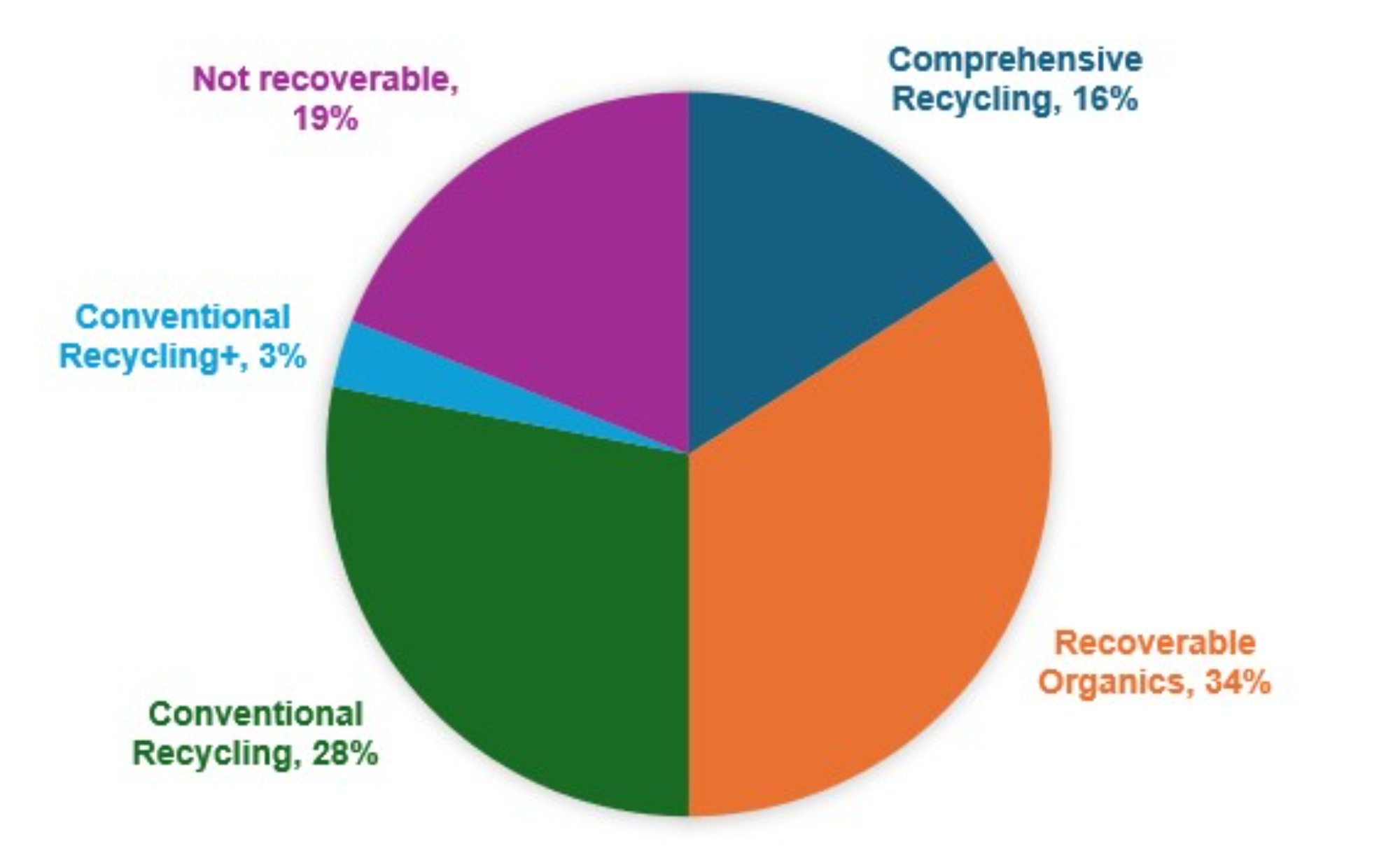

Sorting categories (Table 2) were defined in the context of waste diversion potential through recycling and composting, and attempts were made to ensure consistency with those of the U.S. Environmental Protection Agency and other similar studies.

Composition Findings

Michigan landfills report received volume to the Michigan Department of Environment, Great Lakes and Energy on an annual basis. Based on these regulatory filings there were 8,810,390 tons of MSW landfilled during the 2021-2022 fiscal year that came from Michigan. In addition, the Kent County Waste-to-Energy Facility in Grand Rapids incinerated about 183,112 tons of MSW during 2022. Between these two sources, we estimate that Michigan generates 8,993,502 tons of MSW available for screening for recycling.

Based on the samples collected throughout the state, we estimated the aggregate mixed municipal solid waste composition for Michigan. Most material currently being disposed of through landfills and incinerators could be recycled or composted in most metropolitan communities without great difficulty (Figure 1). Approximately one third of material could be recycled in any community that meets the recycling benchmarks specified in the new Part 115 materials management law (shown below as Conventional Recycling and Conventional Recycling+) which includes glass and other materials not universally accepted in Michigan. In comparison to the 2016 study, there is a statistically significant decrease in materials commonly targeted by recent investments in recycling collection and infrastructure, specifically plastic and mixed paper, suggesting that those improvements are working.

Figure 1: Ease of Recycling for Materials in Michigan MSW (mean % by weight)

Notes: This chart shows the level of difficulty of recycling based on the recycling benchmarks specified in Michigan’s solid waste management law. The difference between conventional recycling and conventional recycling+ is that the latter can accommodate materials that are often but not always accepted by curbside recycling programs in Michigan, specifically glass and cartons. Recoverable organics refers to compostable organic waste such as food waste and yard waste. Some inorganic waste can be recycled through extraordinary disassembly, or niche services such as Terracycle, which allows consumers to mail-in miscellaneous consumer products and packaging. There are also solid waste materials that are considered not recoverable because they are impractical or extremely difficult to recycle, including miscellaneous inorganic materials, certain plastic materials, and non-compostable organics. Some of these materials could be processed through anaerobic digestion, pyrolysis, or other mechanical or chemical processes to increase the potential recycling rate further.

Description: This figure shows a pie chart depicting the percentage of Michigan municipal solid waste by difficulty of recycling. Overall, only 19% is not recoverable or recyclable.

Source: Michigan Municipal Solid Waste Characterization 2024 (Full Report)

The next step in our study was the valuation of MSW which is either incinerated or disposed of in landfills. We used market prices for recycled commodities and peer-reviewed academic studies to estimate the value of recyclables. We also took into account indirect benefits and processing costs to approximate the net recycling value of the different waste materials for recyclers and recycling communities. Altogether, we were able to characterize and quantify the volume and value of Michigan’s MSW, as detailed in Table 3.

Table 3: Michigan Statewide Composition (by weight), Available Material Valuation ($ in millions) and Net Recycling Value ($ per ton)

Description: Table 3 shows Michigan municipal solid waste by percent composition by type of waste, material valuation in millions and net recycling value in dollars per ton.

Source: Michigan Municipal Solid Waste Characterization 2024 (Full Report)

Regarding key waste categories, we find that there is substantially more food waste in Michigan landfills than currently believed, and its contributions to greenhouse gas emissions are greater than previously known. Michigan disposes of an estimated 1.5 to 2 million tons of food waste through its municipal solid waste each year. It was the most common material characterized at 19.16 percent of samples by weight. This was also the case in 2016 when it was 13.5 percent of samples by weight. At the time, we predicted that food waste would become more prevalent as a percentage of MSW as conventional recycling programs improve. This was proven true. If this material was used as feedstock for compost in Michigan, it would be worth an estimated $18 million to $36 million annually. Food waste was found disproportionately in residential loads: 23.8 percent by weight, compared to 9.1 percent for samples from commercial properties. Our findings are consistent with characterization reports from peer states.

Meanwhile, corrugated cardboard is a unique opportunity for the state. Arguably, it is the easiest material to recycle, universally accepted by residential programs and the material most commonly recycled by businesses. Yet it is 11.71 percent of MSW in Michigan by weight representing a commodity value of $75 million during a depressed regional market for the material. At various points over the past five years, it would have been worth two or three times more. Paper products are a combined 24 percent of MSW in Michigan. Although total paper is consistent with peer states, Michigan has relatively more cardboard than any of its peers.

Metal is only three percent of MSW, but approximately a third of the commodity value ($183 million). When including environmental and social benefits, recycling a ton of non-ferrous metal has a net recycling value of $1,697 per ton, the most of any material.

Recoverable plastic is 10 percent of MSW in Michigan, with a total annual commodity value of $259 million disposed of each year in MSW. A majority of that value is from two categories: HDPE Natural (0.86%, $102 million) and plastic film (3.43%, $86 million). Although less than 1 percent of MSW, HDPE is a substantial opportunity. With a net recycling value of $1,527 per ton, there is an economic and environmental case for collection programs targeting that material specifically, similar to scrap programs for metal. The value of plastic bags, wraps, and film may not accurately represent the investment opportunity. Bags tangle processing equipment and impair MRF the operations of the materials recovery facility (MRF) enough so that many facilities do not accept the material.

Below is a summary of other key findings:

- There was a statistically significant increase in unclaimed bottle containers in comparison to the previous study. There are now an estimated 1.3 billion unclaimed bottle containers in the municipal waste stream, three times more than in 2016.

- Non-food, non-fiber organic waste was 17.4 percent of total samples. Wood was the most prevalent material. Including food and non-food organic material, as much as 34 percent of MSW could be composted, although this may overstate the compostability of wood and paper products.

- The share of electronic waste has decreased by more than half since 2016. It is now approximately 1.5 percent of MSW. Although a characterization of electronic waste to precisely determine the presence of lithium-ion batteries was not possible, we can confidently estimate that there are no less than 30 million lithium-ion batteries in the state’s municipal solid waste stream.

- There are an estimated 29 million “vape pens” in the municipal solid waste stream. These are a large, if not the largest, vector for lithium-ion batteries in the state’s MSW and could be a contributing factor to the increasing number of fires at solid waste management facilities in the state.

- There is a robust secondary and tertiary market for textile products, especially used clothing. However, industry stakeholders highlight that all textiles do eventually end up in the landfill, and it is difficult to determine where materials sampled in this study currently were in the product life cycle. We estimate that Michigan disposes of 271,893 tons of textile waste through MSW, a total commodity value of $26 million.

- Recycling facilities that process MSW universally indicate that glass has a negative value in their operations, meaning that they have to pay their customers to take it. However, glass that is processed through the deposit redemption program is sold to end markets in Michigan for $60 per ton.

Economic Valuation

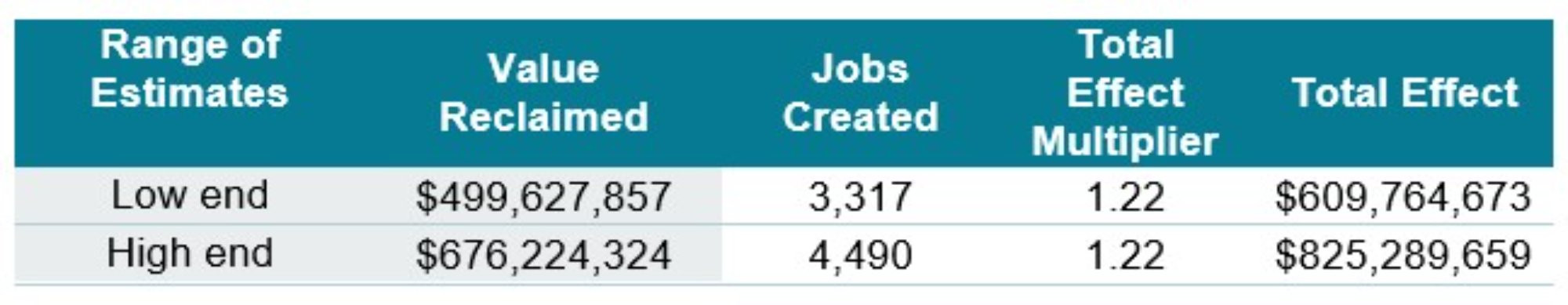

We estimate that the material disposed of in Michigan’s municipal solid waste each year has a market value of $500 million to $676 million. If this material were collected for recycling, it would have an estimated economic impact of $609 million to $825 million per year, creating as many as 4,500 jobs (Table 4). In comparison, the 2016 Michigan MSW characterization study estimated the value of the state’s 8.4 million tons of landfilled materials at between $293 million and $368 million.

Table 4: Economic Impact Potential of Recycling MSW

Description: Table 4 provides a low end and a high-end estimate of the potential economic impact of recycling municipal solid waste in terms of dollar value reclaimed, jobs created, the multiplier effect and the total effect.

Source: Michigan Municipal Solid Waste Characterization 2024 (Full Report)

Each year that Michigan does not make investments in infrastructure, adopt new business practices, provide the necessary education to stakeholders, or advance and execute the public policy needed to increase the recycling rate, the state will lose at least a half billion dollars of potential feedstock for its manufacturers, farms and other end markets. The estimated lost value per year is detailed in Table 5.

Table 5: Projections of Economic Impact Potential of Recycling MSW

Description: Table 5 provides projections of economic impact potential from recycling municipal solid waste in the years 2023, 2025, 2030, and 2035 based on population projections in those years and the estimated tons of municipal solid waste generated and the low and high value of potential economic impact in each of those years.

Source: Michigan Municipal Solid Waste Characterization 2024 (Full Report)

In conclusion, this study demonstrates the economic and environmental benefits of expanding recycling in its various forms in Michigan. The economic opportunity is substantial and should be met with a sense of urgency. Likewise, recycling provides a measurable environmental benefit over the landfill. Moreover, as infrastructure and demand for recycled materials grow, so do the economic and environmental opportunities. But not all recycling (or composting) is mutually beneficial, prevention of waste through source reduction and reuse should also be prioritized.

References

Michigan Department of Environment, Great Lakes, and Energy (2023) Report of solid waste landfilled in Michigan, October 1, 2021 - September 30, 2022.

Schoonmaker, D., Lowen, A., Isely, P., and Kneisel, A. (2016) Michigan Municipal Solid Waste Characterization and Valuation: Opportunities for Economic and Environmental Impact.

Schoonmaker D., Cruz C., Lowen A., Veldman C. (2024). Economic Impact Potential and Characterization of Municipal Solid Waste in Michigan. Michigan Sustainable Business Forum. misbf.org/msw.