American Rescue Plan Act Funding for West Michigan

By Christopher John Cruz, Ph.D., Assistant Professor, Department of Economics

Bobbie Biby, MBA, Affiliate Professor, Department of Economics

President Biden signed into law the American Rescue Plan Act of 2021 (ARPA) in March 2021 to deliver unprecedented direct relief to the American people and to help rescue the economy reeling from the COVID-19 pandemic. The Coronavirus State and Local Fiscal Recovery Funds (SLFRF) is a component of ARPA which was specifically intended to deliver $350 billion to state, local, and Tribal governments. According to the U.S. Department of Treasury (2022), the SLRF program ensures that local governments have the resources to (1) support families and businesses economically impacted by COVID-19, (2) maintain essential public services amid declines in revenues, and (3) support long term growth and opportunity.

The Treasury issued the Interim Final Rule which described the eligible and ineligible uses of the ARPA’s SLRF funds in May 2021, but it was not until January 2022 when the Final Rule was issued. The Final Rule identifies four eligible use categories for the funds: (1) revenue replacement, (2) COVID-19 public health and economic response, (3) premium pay for essential workers, and (4) infrastructure investments. Recognizing the significant revenue losses during the pandemic, the Final Rule allows local governments to use all or part of the ARPA funds to help address lost revenue. Specifically, local governments are given the option to select a standard allowance for revenue loss of up to $10 million or complete a full revenue loss calculation in case their revenue loss exceeds $10 million. Recipients can use this amount (in many cases, the full award) for government services. Local governments are also allowed to use ARPA funds to support their local public health and economic responses. These projects may include affordable housing, childcare facilities, schools, and hospitals. In addition, the Final Rule provides local governments the ability to provide premium pay to workers performing essential work. Finally, the Final Rule broadens eligible infrastructure projects to include water and sewer as well as broadband infrastructure. The broadband investment addresses internet access, reliability, and affordability issues highlighted and exacerbated by the pandemic. The first half of the ARPA funds allocation was sent to local governments in May 2021, and the other half was scheduled to be delivered in 2022. Local governments have until December 31, 2024 to obligate (i.e., allocate) the funds and until December 31, 2026 to expend all relief funds.

The Seidman College of Business and the Grand Rapids Chamber of Commerce are conducting a study to track local projects supported by the ARPA funds with the goal of estimating how these funds affected the economies of counties, cities, and townships in West Michigan. The study focuses on four counties (Allegan, Kent, Muskegon, and Ottawa) as well as 17 of the most populous cities and townships in West Michigan, including the City of Grand Rapids, and the cities of Muskegon, Wyoming, Muskegon Heights, Holland, Kentwood, Georgetown, Plainfield, Gaines, Byron, Grand Rapids Township, Grandville, Ada, Caledonia, Algoma, and East Grand Rapids.

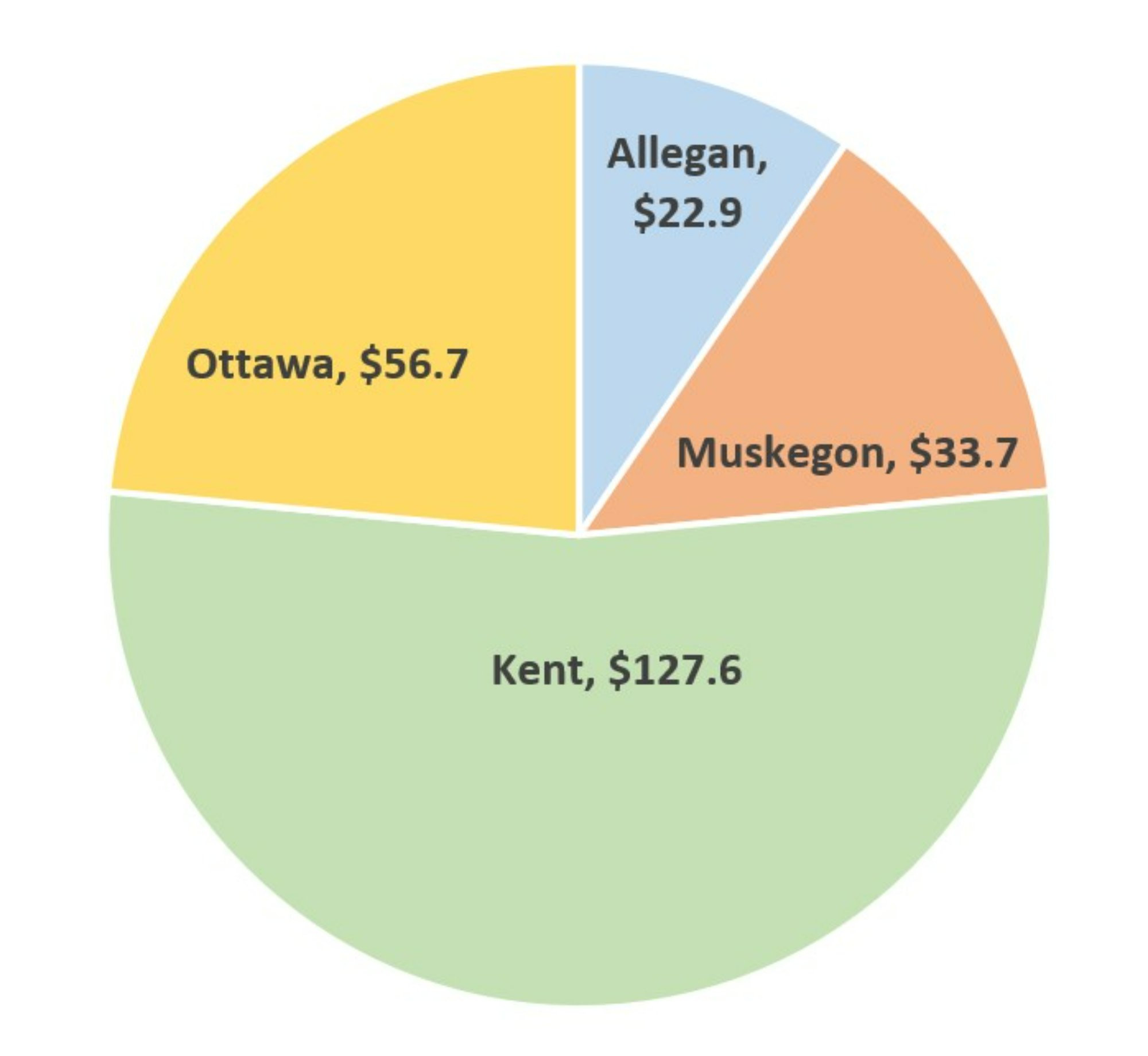

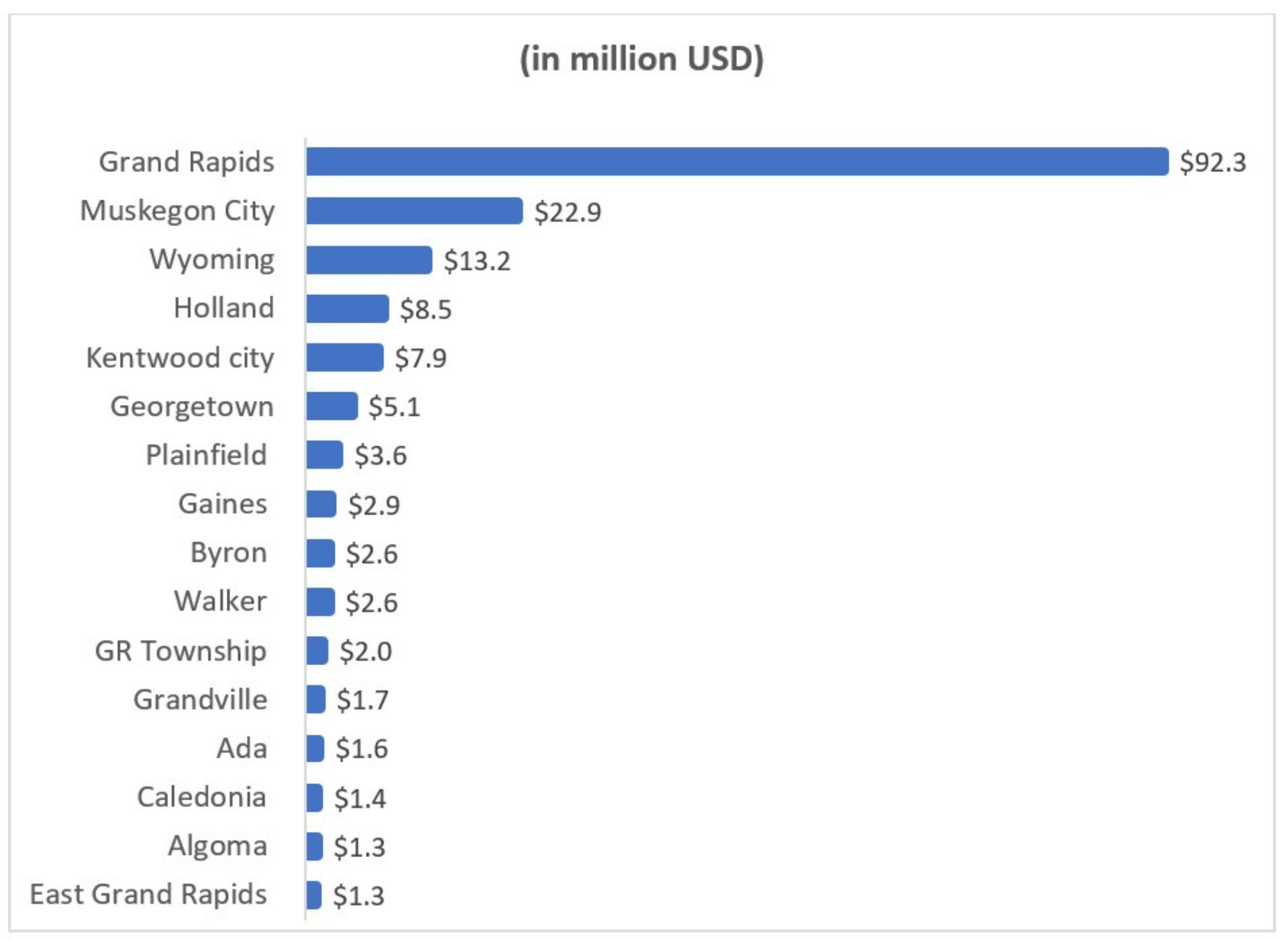

The West Michigan counties of Allegan, Kent, Muskegon, and Ottawa were allocated approximately $240.9 million in total. As shown in Figure 1, the majority of West Michigan’s ARPA funding was allocated to Kent County ($127.6 million), followed by Ottawa, Muskegon, and Allegan Counties. Meanwhile, the 17 municipalities in our study were allocated about $181.3 million combined. The cities of Grand Rapids and Muskegon were given the largest amounts - $92.3 million and $22.9 million - respectively (Figure 2). The ARPA funding allocation was computed as a function of the local population. Consequently, the smaller municipalities have smaller ARPA allocations.

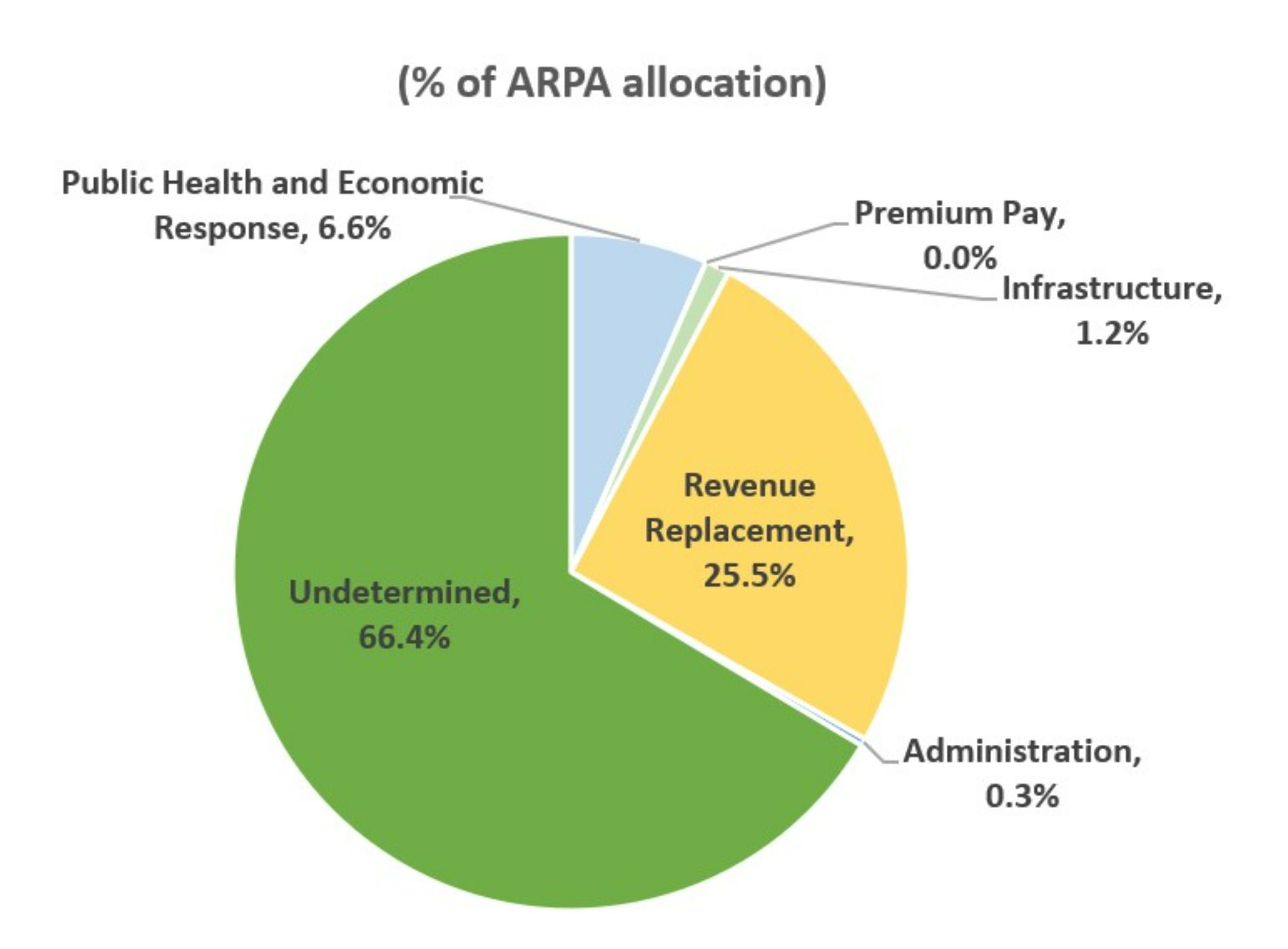

Based on the official reporting of the Treasury Department as of the end of Q2 2022, the different counties and municipalities in West Michigan have obligated about $141.7 million to various spending areas.1 This represents about 34 percent of their total ARPA allocation of $422.2 million. The bulk of ARPA funds have been obligated to revenue replacement at $107.7 million or 25.5 percent of the total ARPA funds (Figure 3). This may not be surprising as the small municipalities have opted to use this reporting category because of streamlined reporting requirements. The municipalities which reported 100 percent revenue replacement include Ada, Algoma, Byron, Caledonia Township, East Grand Rapids, Gaines, Grand Rapids Township, Grandville, Holland, Plainfield, and Walker. Meanwhile, about $27.7 million has been allocated to initiatives related to COVID-19 public health and economic response. Those reporting spending in this category include Allegan, Muskegon, and Kent counties, as well as the cities of Grand Rapids, Kentwood, Muskegon, and Wyoming. Few municipalities (Allegan and Kent Counties and Georgetown Township) plan to invest in infrastructure projects ($4.9 million). A small portion of the funds are allotted to program administration while so far, no municipality has reported using their ARPA funding to provide premium pay to essential workers.

Focusing on the City of Grand Rapids, official Treasury data as of Q2 2022 indicate that the city has obligated almost $17.5 million to various eligible projects. This is about 19 percent of the total allocation to the city of $92.3 million. Almost $2 million is obligated to fund public health and economic response projects, including:

- City of Grand Rapids COVID-19 testing initiative

- Purchase of health screening checks and mobile hot spot devices for employees to continue remote work

- Purchase of masks, gowns, wipes, gloves, and hand sanitizer for workplace safety in city facilities

- Purchase of survey tool to improve service delivery

- Reimbursement for costs of medical expenditures related to COVID

- Mental health services

- Free Wi-Fi access in parks

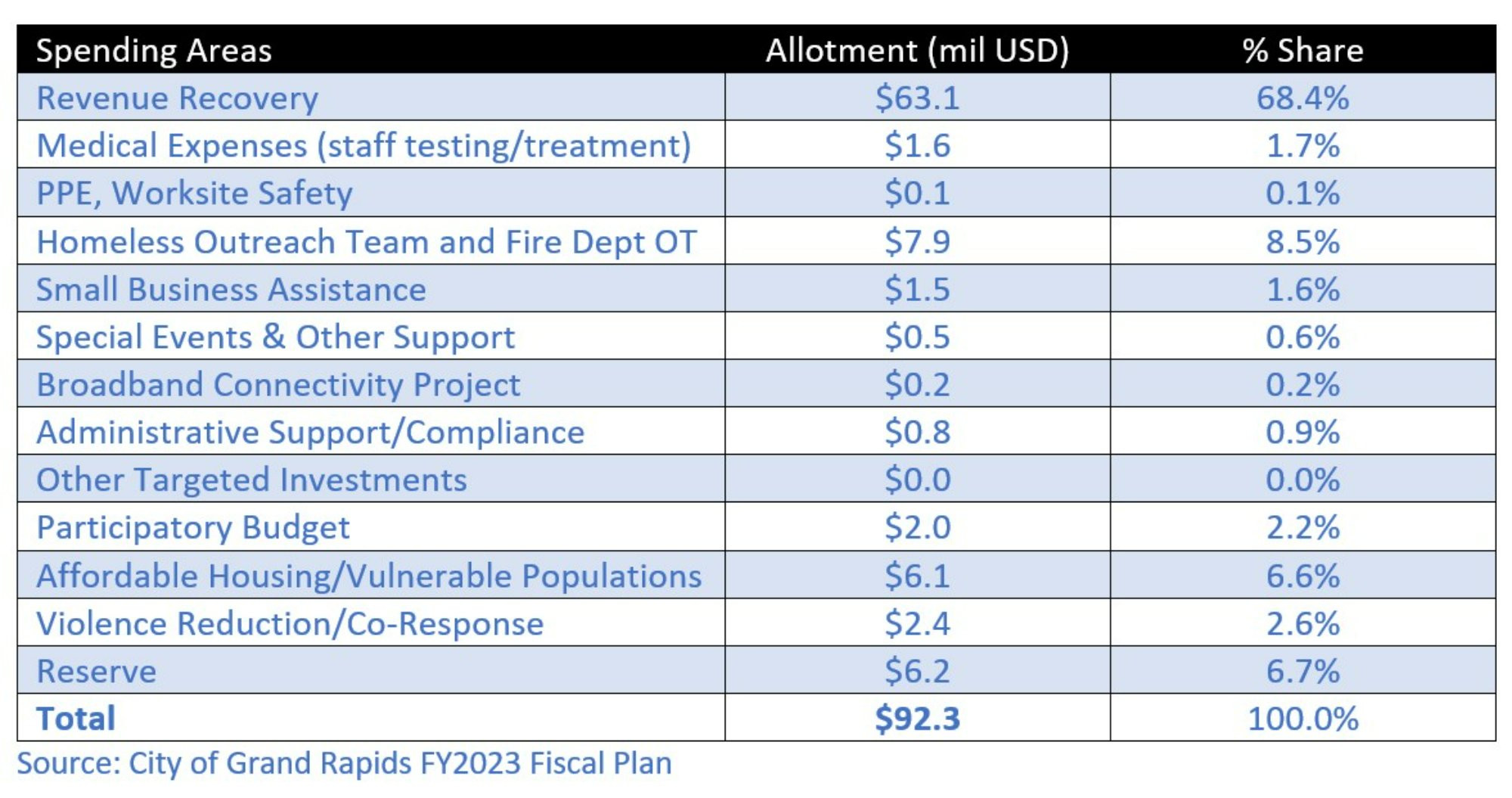

In May 2022, the City of Grand Rapids released its fiscal plan for 2023 which includes an updated spending plan for its ARPA funds. More than two-thirds of the city’s ARPA funds are allotted to revenue recovery ($63.1 million). Other key spending areas cater to vulnerable communities, including homeless outreach ($7.9 million) and affordable housing ($6.1 million). About $2.4 million is allotted to violence response while about $6.2 million has been set aside as reserves.

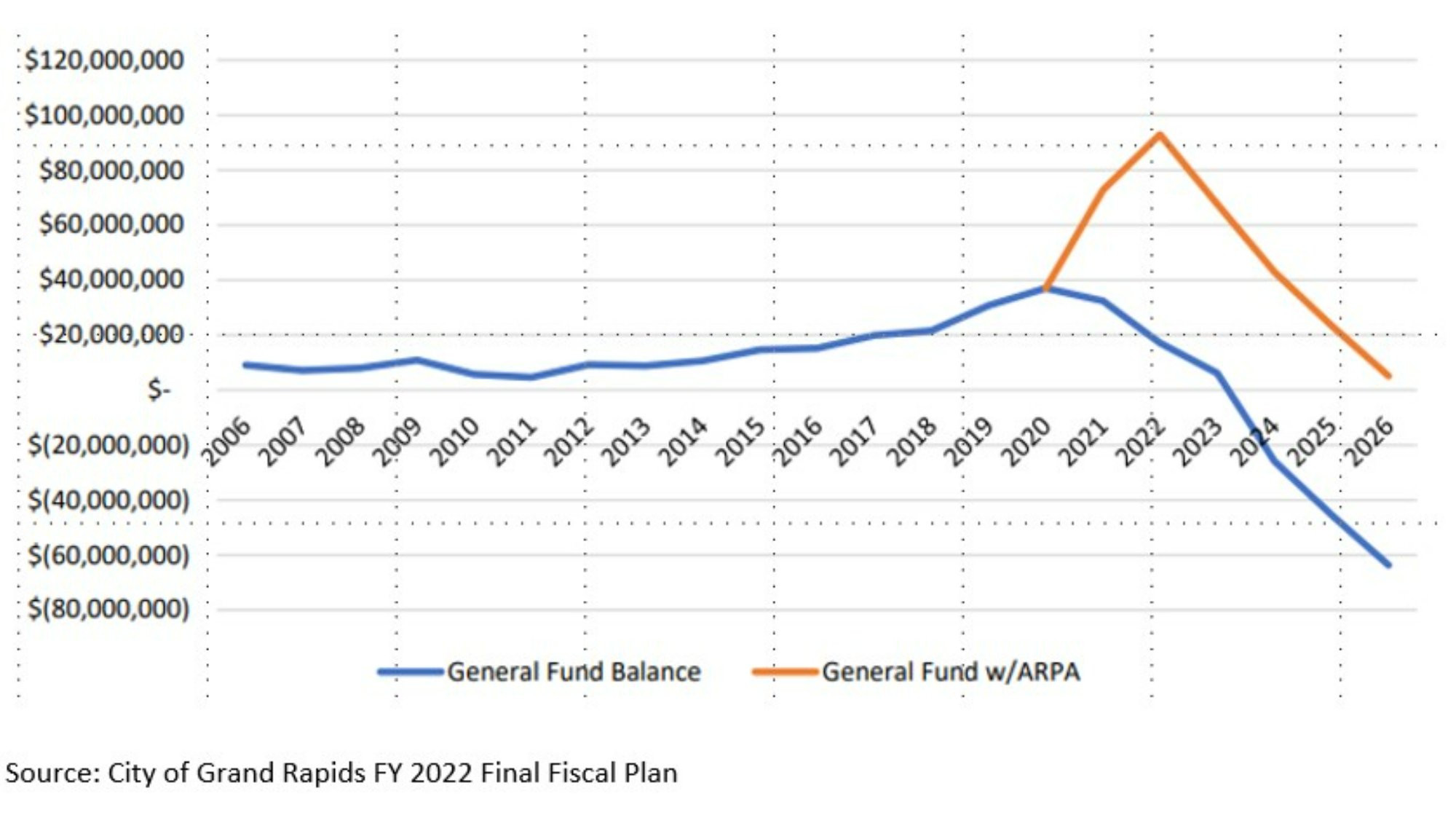

The ARPA funding has and will continue to have a huge impact on the City’s fiscal situation. Projections by the City published in its 2022 budget (Figure 4) indicate that without the ARPA funds, the City’s general fund is estimated to dip to negative territory until 2026. The ARPA funding is expected to significantly raise the general funds in 2022 for the city of Grand Rapids and keep it in positive territory.

Summary

In summary, the scope of ARPA funding is unprecedented. Although the ARPA funds are meant to strengthen the country’s emergency response to the pandemic, most counties and municipalities in West Michigan have yet to expend their funding allocations. Based on our calculations using official data from the Treasury Department, only 34 percent had been obligated as of Q2 2022. Municipalities with smaller allocations plan to use all of the funds for revenue replacement, while larger cities and counties are still in the process of determining or have just approved specific uses. A few of them, including Kent and Ottawa Counties, have recently requested public participation in finding the best use of the funds. As local governments are given through 2024 to obligate their respective ARPA funds and through 2026 to spend them, we anticipate the impact of these funds to be gradually felt in West Michigan in the coming quarters.

Technical Notes

[1] For counties and municipalities with no updates for Q2 2022, data from the Q1 2022 report were used.

References

City of Grand Rapids. (2021). City of Grand Rapids FY 2022 Final Fiscal Plan. Retrieved from https://www.grandrapidsmi.gov/Government/Departments/Budget-Office/Library

City of Grand Rapids. (2022). City of Grand Rapids FY 2023 Final Fiscal Plan. Retrieved from https://www.grandrapidsmi.gov/Government/Departments/Budget-Office/Library

U.S. Department of the Treasury. (2022). Coronavirus State & Local Fiscal Recovery Funds:

Overview of the Final Rule. Retrieved from

https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-Overview.pdf