Grand Rapids Economic Forecast 2023

By Paul Isely, Ph.D., Associate Dean, Seidman College of Business

Kuhelika De, Ph.D., Associate Professor, Department of Economics

Marcus Lynch, Graduate Assistant

- The Current Business Confidence Index for the end of 2022 is 69.6%, lower than expected last year.

- The Forecast Business Confidence Index for 2023 is 67.2%, showing reduced expectations for 2023.

- Employment is expected to grow by 1.6% to 2.0% in 2023, showing slower growth than 2022.

- Overall nominal sales are expected to increase by 2.0%-2.6% for 2023, a slowdown in growth expectations from 2022.

- Wages are expected to increase by 3.9% - 4.3% for 2023 slower than the increases seen in 2022.

- Prices are expected to increase by 5.3% - 5.9% for 2023 slowing the inflation seen during 2022.

- All indicators signal the West Michigan economy will slow during 2023.

Introduction

The survey for the greater Grand Rapids economy including Kent, Ottawa, Muskegon, and Allegan counties (KOMA) was conducted in November and December 2022. A survey was mailed to the CEOs and business leaders representing nearly 1,000 organizations based on a representative sample. We tried to ensure that the sample reflected different sectors of the regional economy and the geographical diversity of the area. The survey was timed for the week after the elections to allow respondents the opportunity to digest some of the possible implications of the elections.

Ultimately, 121 organizations responded, resulting in a strong response rate of 12.7%. However, due to the possibility of a non-random response sample, the survey should be interpreted with caution.

A few methodological considerations are in order. Although we discuss the survey results in terms of averages, the data are represented in a histogram format to show the entire distribution of responses. The employment and sales numbers are more volatile as raw averages (when calculated without adjusting for outliers—responses beyond one standard deviation). Since the average of a small sample is significantly influenced by extreme numbers, we use the averages without the outliers to provide more reliable results. The histograms, however, depict all the available observations to show the broad picture dealing with uncertainty: new COVID surges, supply chain problems, cost and wage pressures, and inflation. However, confidence is still above what it normally is in a year where a recession is anticipated. This suggests that businesses that responded, view this as a transitory issue and not a fundamental change in the economy. The result is a confidence level similar to the 2003-2005 timeframe between the last recessions.

Confidence Index

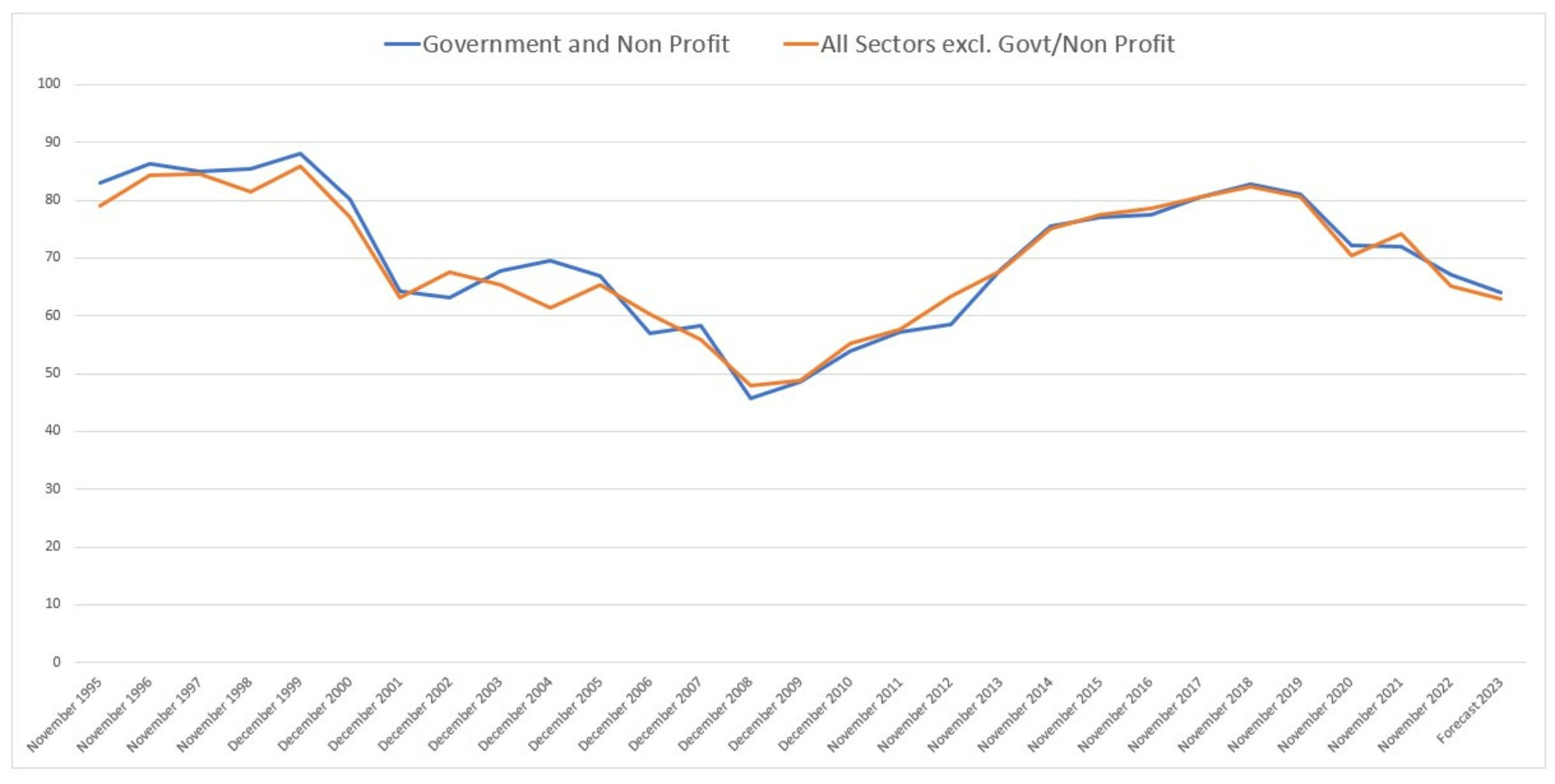

The Confidence Index has been tracked by researchers at the Seidman College of Business since 1995. A continuing goal of the survey is to historically track the overall business confidence of the Grand Rapids area. The Confidence Index respondents use a scale from zero percent (no confidence at all) to one hundred percent (complete confidence) in response to the question: How confident are you in the regional economy? The average responses for the private sector and the government/non-profit sector over the past 20 years are shown in Figure 1.

Unsurprisingly, the Confidence Index continued to fall over 2022, and that trend is expected to continue in 2023. The economy is coming off the post-pandemic expansion and is facing increasing interest rates as the Federal Reserve tries to slow the economy to reduce inflation. Businesses are still dealing with uncertainty: new COVID surges, supply chain problems, cost and wage pressures, and inflation. However, confidence is still above what it normally is in a year where a recession is anticipated. This suggests that businesses that responded, view this as a transitory issue and not a fundamental change in the economy. The result is a confidence level similar to the 2003-2005 timeframe between the last recessions.

Employment

Last year employment for KOMA was projected to grow at an average of 2.9%, and so far between November 2021 and November 2022 the region grew by 2.7%. Businesses have been unable to hire at the rate they wanted as there are not enough applicants in the labor pool. Over the next few months as the economy slows, businesses will finally be able to make progress with their hiring plans.

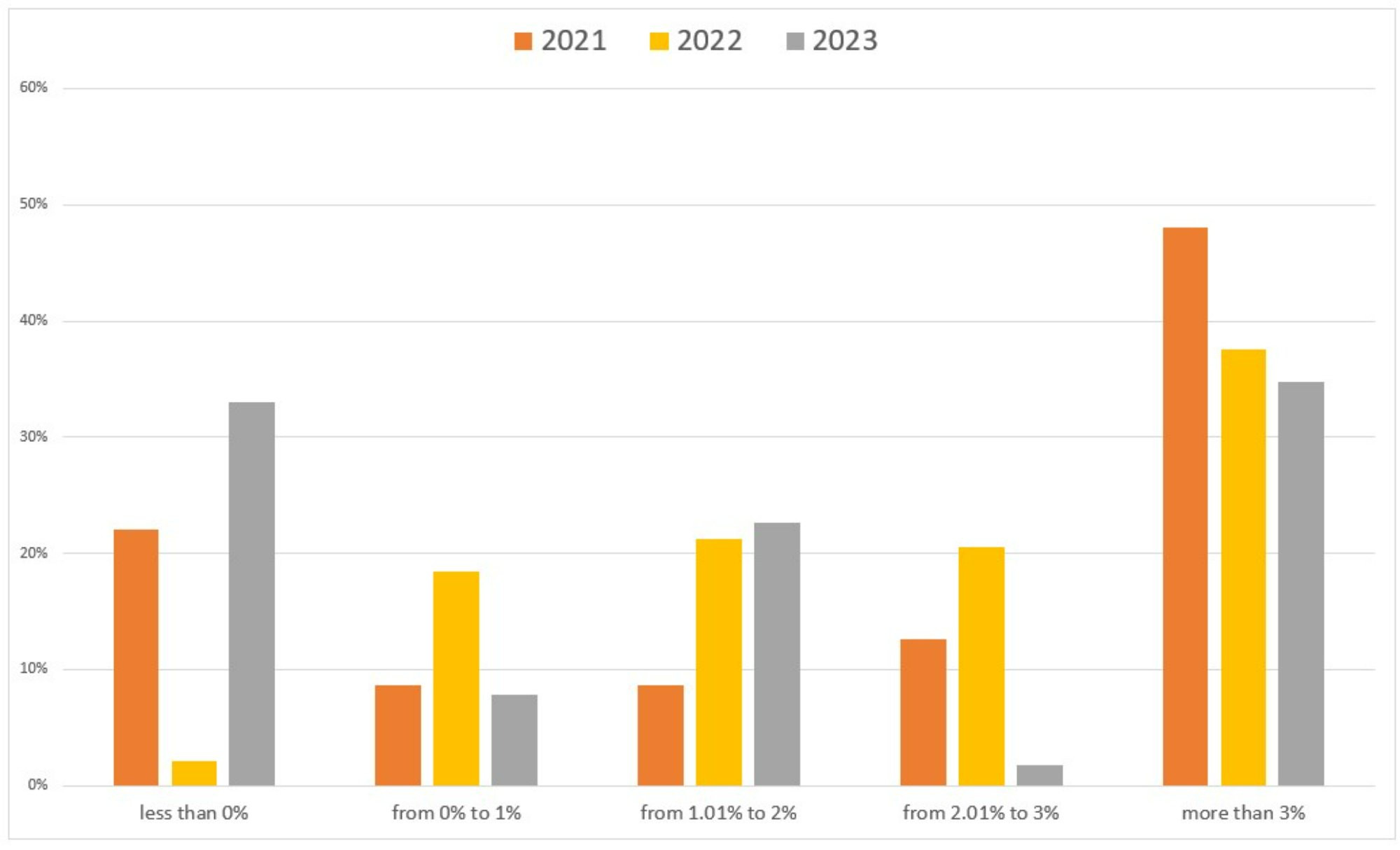

The responses to the question: What percent change do you expect in employment for the four counties in 2023? are shown in Figure 2.

Average employment in the KOMA region during 2023 is expected to grow at a much slower pace of 1.8%, provided there are enough people in the labor force. Last year only 2% of firms expected to see employment shrink. This year 33% of firms expect to cut employment. However, a third of firms still expect to grow at more than 3%. This is consistent with firms trying to catch up on hiring. It also shows that the anticipated slowdown will affect sectors differently.

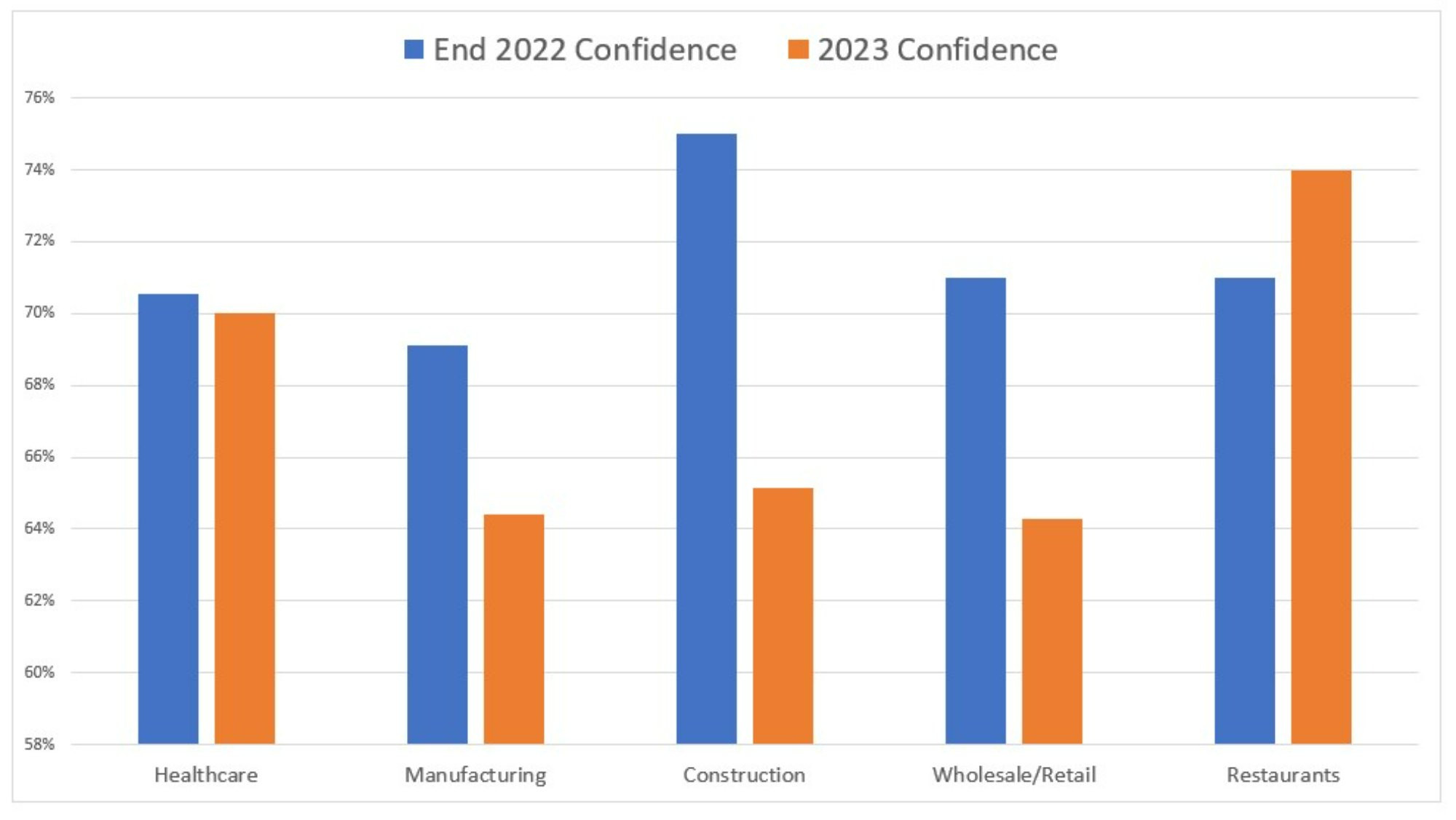

This can be seen in the confidence exhibited in different industries in West Michigan as shown in Figure 3. Confidence by goods producers is declining while it increases with service providers.

This year we also asked about wages. The average increase in wages is expected to fall to 4.1% in 2023 from 4.8% in 2022. However, 20% of respondents are still looking at more than a 10% increase in wages. Part of this is in response to inflation pressures. Business leaders across West Michigan are reporting an average inflation expectation of 5.6% this year. It is also a response to increased competition for labor across the region. If increases in benefits were included, it is likely the compensation increases will be on par with inflation expectations based on conversations with business leaders.

Sales

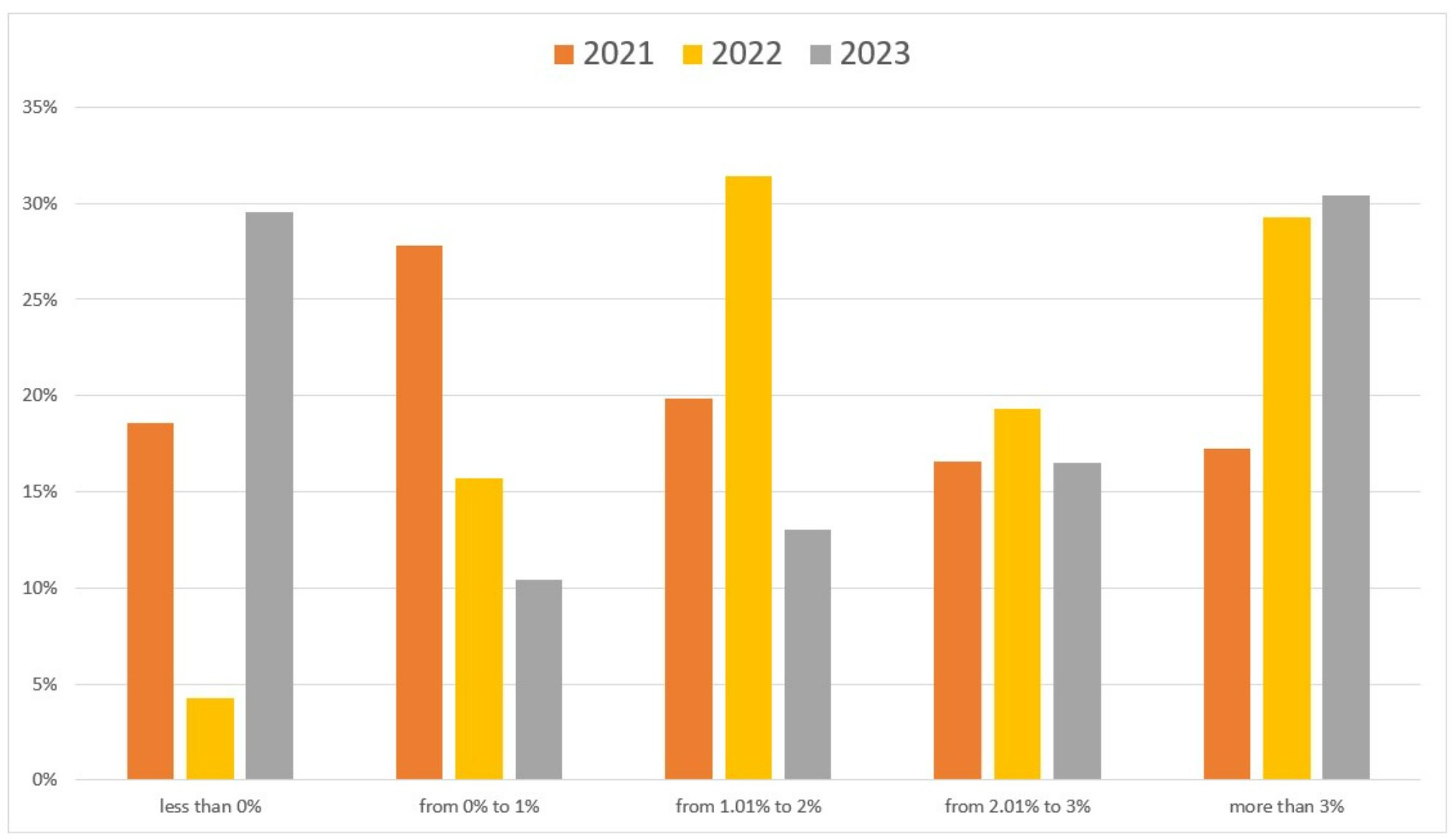

For sales, the respondents answered the following question: What percent change in sales do you project for the four counties in 2023? Results are

Shown in Figure 4. During the late 1990s, sales grew at an annual rate of 5%.

Survey respondents are expecting sales growth around 2.3% during 2023. However, nearly a third expect sales to slow with more than a third looking for sales to grow in excess of 3%. This is again consistent with a sectoral slowdown indicative of a shallow recession.

Inflation

Consumer price inflation averaged 7.12% over the 12 months ending in November 2022. It remained elevated primarily due to strong wage growth and the effect of supply constraints on prices. The Inflation Expectations Index, which combines information from many indicators of inflation expectations and inflation compensation, remained above pre-pandemic levels. With the effects of supply–demand imbalances in goods markets expected to unwind and labor and product markets expected to become less tight, we project that inflation will decline consistently over the next two years.

On a 12-month change basis, we present projections for the U.S. inflation rate measured by the Consumer Price Index for 2023 from three different sources in Table 1: Seidman Business Survey report, Federal Reserve’s Federal Open Markets Committee (FOMC) projection, and calculations from our time series forecast model.

General Outlook

The data for West Michigan shows a slowdown in 2023 compared to 2022. However, that slowdown will be uneven with construction and interest sensitive industries slowing and services continuing to show some strength. As inflation eats away at purchasing power and drains savings, there is the potential for a quicker slowdown in the second half of the year. This could accelerate if the Federal Reserve is more aggressive than expected in raising the federal funds rate.

Acknowledgements

We are very grateful to all the organizations that participated in the 2023 Confidence Index Survey.