West Michigan Stock Returns

By Gregg Dimkoff, Ph.D., Professor, Department of Finance

“West Michigan Stock Prices Increased 12.0% in 2021”

The West Michigan Stock Index increased 12.0% in 2021. That is a great annual return, but just as in 2020, it is low when compared with several widely followed stock market indices.

Table 1 below highlights both 2021 and 2020 annual returns for several indices.

Table 1 - 2021 Stock Market Returns

1The West Michigan Stock Index consists of 15 publicly traded companies headquartered in West Michigan. Each company’s return is weighted by its market value -- the number of shares of common stock outstanding multiplied by the company’s stock price. The index matches the weighting methodology used by the NASDAQ Composite Index. The Dow Jones Industrial Average is price weighted, while the S&P 500 Index uses a somewhat complex method dividing the sum of the market values of each component stock by a proprietary index divisor.

All of the returns in Table 1 should bring glee to just about everyone. Years from now, it is likely we will look back at the past two years and refer to them as “the good old days” of stock investing.

There is not a single company comprising the West Michigan Stock Index that is also a component of the Dow Jones Industrial Index. Accordingly, comparing West Michigan company returns with the Dow is not appropriate. Likewise, only three West Michigan companies – Kellogg, Stryker, and Whirlpool – are components of the S&P 500 Index, minimizing the appropriateness of comparing returns with that index. That leaves the NASDAQ Composite Index as the most appropriate benchmark for comparing the West Michigan Stock Index, and by that comparison, West Michigan-based stock returns do not look as strong.

Table 2 below ranks the fifteen companies comprising the West Michigan Stock Index by their 2021 returns. The West Michigan Stock Index weights each stock’s return by its market capitalization. Accordingly, the higher a stock’s price and the more shares outstanding, the higher the weight, and the greater the impact that stock has on the Index. For instance, Meritage Hospitality Group Inc. has about 6.7 million shares outstanding, while Stryker has 377 million, about 56 times more. Further, Stryker’s stock price is about 12 times greater than Meritage. These two factors give Stryker a market weight of nearly 700 times that of Meritage. That explains why the West Michigan Stock Index’s (the Index) performance is dominated by the largest corporations: They have the largest market capitalizations.

The 2021 performance of each of the fifteen companies comprising the Index is described below. Most of the discussion is based on year-to-date performances as reflected in quarterly earnings reports through the most recent quarter as of early January, 2022. Companies are grouped by industry or otherwise listed alphabetically.

The Banks

There are four banks headquartered in West Michigan: Independent Bank Corporation, Macatawa Bank Corporation, Mercantile Bank Corporation, and ChoiceOne Financial Services, Inc. The COVID-19 pandemic was not kind to them in 2020, but for the most part, they have recovered well.

The Federal Government pumped approximately $7 trillion into the economy during the pandemic. Household wealth increased significantly for every income demographic in the U.S. As a result, demand for everything exploded, creating an economic boom for the banking industry. Rapid U.S. economic growth led to much, much higher levels of deposit and commercial loan growth, and earnings are up across the board. Further, banks have more cash than they can loan out, so they are buying back their shares, returning money to shareholders in a series of one-year buyback plans instead of making huge increases in dividends.

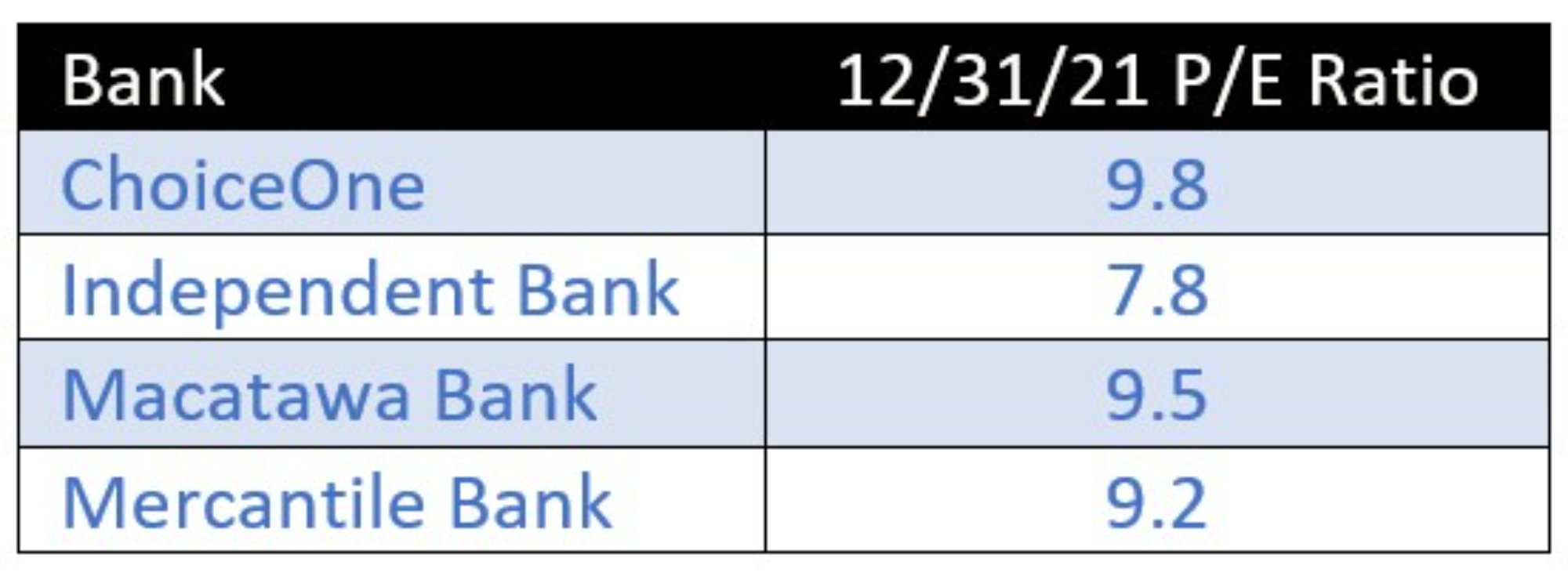

Investors often use the price/earnings ratio as a measure of how fair a stock’s price is relative to the earnings a company is generating. All West Michigan-based bank stocks seem fairly priced compared with each other as shown in Table 3.

No individual bank price is substantially higher, or lower, than the others. Overall, however, these P/E levels are lower than their historic average of around 15. Whether factors affecting banking profitability and risk change in 2022 is a good question. If they improve, prices will rise at faster rates than earnings, and P/E ratios will increase. Investors hope that will happen.

ChoiceOne Financial Services, Inc.

ChoiceOne Financial Services, Inc. is the holding company for Sparta-based ChoiceOne Bank. The bank’s stock price peaked at $33 per share on February 1, 2020 and held around that price as 2021 began. But by the end of April, however, it had fallen to a little less than $23 and ended the year at $26.49. The bank announced a stock repurchase plan in April to buy back up to 390,000 shares representing five percent of its total shares. Through the first nine months of 2021, it had purchased 223,000 shares.

ChoiceOne was named the best small bank in Michigan by Newsweek in October 2021, the second year in a row the bank has received this recognition. To be considered for the designation, banks must have less than $10 billion in assets, have enough branches to rank in the top five within its state, and be headquartered in the state.

Independent Bank Corporation

Grand Rapids-based Independent Bank Corporation, the holding company for Independent Bank, has 59 branches and $4.6 billion of assets. The bank’s price has fluctuated in the low $20-dollar per share range for most of the past four years. Surprisingly, earnings per share have grown by more than two-and-one-half over that period, and usually stock prices increase in step with earnings growth. That hasn’t happened, and instead, the P/E ratio fell.

Total deposits and commercial loans both grew significantly during the first three quarters of 2021. In fact, CEO Brad Kessel reported in late October that the bank’s “commercial pipeline is at its highest level in many quarters.” The bank also announced it would repurchase 5% of its shares, approximately 1.1 million shares, in 2022. It repurchased 790,000 shares in 2020.

Macatawa Bank Corporation

Macatawa Bank Corporation is the holding company for Macatawa Bank. The Holland, MI-based bank has 26 branches across three West Michigan counties: Kent, Ottawa, and Allegan and has $2.9 billion of assets.

Its stock price varied during the year, but ended 2021 with a small price increase of $0.53. The steady price reflects the bank’s nearly level earnings. For instance, net income in the third quarter of 2021 was $7.2 million versus $7.1 million year-over-year. Yet there is optimism for 2022 as commercial loans, an important component of bank revenue and earnings, grew by 30% in the third quarter and by 82% relative to the 2021 second quarter. Further, total deposits grew rapidly. Macatawa Bank’s stock price should do better in 2022.

Mercantile Bank Corporation

Grand Rapids-based Mercantile Bank Corporation is the holding company for Mercantile Bank of Michigan. The bank has just shy of $5 billion of assets and 43 banking offices.

Overall, the bank experienced few enduring economic pains from the COVID-19 pandemic. 2021 earnings were strong, rising 58% through the first three quarters, and Zacks (an investment research company) rated Mercantile a strong buy, its highest rating, on July 28 when the price was $31.50. By December 31, investors had bid up the stock price to nearly its highest level in almost 14 years.

Mercantile Bank repurchased 630,000 of its stock shares through the first nine months of 2021, a 3.6% reduction in total shares. It has $11 million remaining in it repurchase plan, enough money to repurchase more than 300,000 more shares at the stock’s current price.

The Office Furniture Industry

The same challenges that affected the outlook for the office furniture industry in 2020 remained in 2021, namely, office workers working from home because of the pandemic, reducing the need for more office buildings and office furniture. From an investor perspective, the concern is that the need for office furniture will be permanently reduced from pre-pandemic levels, reducing the attractiveness of either stock in the West Michigan Stock Index.

MillerKnoll, Inc.

Zeeland, MI-based Herman Miller announced it was changing its name to MillerKnoll, Inc on July 19 reflecting its $1.8 billion merger with Knoll, Inc.

Herman Miller’s stock began the year at $33.80, rose to nearly $50 by early June, and then fell to $39.19 by December 31. The price decrease mostly reflected investor reaction to the September 29 quarterly earnings announcement. Earnings were up sharply, but so were expenses. The company lost $61.5 million for the quarter with negative earnings per share of $0.93. Additionally, debt increased five-fold. Most of the bad news reflected costs of acquiring Knoll, Inc.

Steelcase Inc.

Steelcase is a speculative stock investment right now. Its stock price fell by 13.5% during 2021 after falling 33.8% in 2020. It earned a paltry $0.10 over the past twelve months, and its P/E ratio is an astounding 117. As if that weren’t enough to cause the stock price to fall, investors would not like the fact that net income has fallen 13.2% over the past five years compared with an industry increase of 10.2%. Also, over the past year, net income fell 96% vs. a 35% increase for the industry. Part of Steelcase’s financial issues were caused by a two-week worldwide shutdown of its operation due to a cyberattack beginning October 22.

On a more optimistic note, the company raised its annual dividend from $0.40 per share to $0.58, a 45% increase. That’s far higher than its earnings per share of $0.10, but dividends are paid with cash, not earnings. The huge dividend increase suggests either future financial trouble, or great optimism by the Board of Directors. The coming year will be an interesting one for Steelcase.

The Other Companies

Gentex Corporation

Zeeland, Michigan-based Gentex is a supplier of digital vision, connected car, dimmable glass, and fire protection technologies. The company’s stock increased 20.3% during 2021, closing at $34.85 after having reached an all-time record high price of $37.52 in early November.

Parts shortages caused light-vehicle production in Gentex’s primary markets to fall 23% in the third quarter. As a result, sales of Gentex vehicle mirrors fell 2.5-3.0 million units in the third quarter, and earnings per share dropped to $0.32 from $0.48 in the same quarter last year. Fourth quarter sales and earnings are projected to increase, however. Gentex announced that its estimated revenue for 2022 will be 15-20% higher than its previous forecast in the third quarter. In addition, parts shortages eventually will end, and Gentex will resume its decades long history of growth.

Gentex repurchased 2.83 million shares in the third quarter. Its board of directors approved a new repurchase plan for 25 million additional shares, a little more than 10% of its total shares outstanding.

Kellogg Company

Battle Creek-based Kellogg manufactures and markets ready-to-eat cereal and convenience foods. Its stock price has been choppy over the past 8 years, mostly trading somewhere in the $60 per share range, and 2021 was no different. The company’s stock price rose only $0.60 from the beginning of the year to the end.

Through the third quarter, sales rose 5.6%, while 2021 earnings per share are projected to grow 1-2%, adjusted upward from a previous projection of 1%. Supply chain issues and cost increases have affected results.

The company has been expanding in emerging markets, and continues with product innovations in the U.S. Investors should realize Kellogg is a solid, mature company. They should expect no major surprises in 2022, but also expect no major stock price changes.

Meritage Hospitality Group Inc.

Grand Rapids-based Meritage is the nation’s largest owner of Wendy’s restaurants, as well as the owner of several other types of restaurants. In total, the company owns 345 restaurants and plans to open 27 new restaurants in 2022. Restaurant owners struggled to stay open during the pandemic, but the issue now is mostly about getting enough workers and passing on the resulting higher costs. Meritage’s sales increased 13.9% through the third quarter compared with 2020, but the bar was relatively low as 2020 was a horrible year for almost any type of restaurant. The company’s net income has attained pre-pandemic levels, and its stock price increased a respectable 12% during the year.

Perrigo Corporation PLC

The company describes itself as a consumer self-care company, poised for strong growth, and unencumbered by the major overhangs of the past. The following are reasons for the optimism and for the company’s stock falling 13% in 2021.

Reasons for optimism include these events. Perrigo:

- Sold its prescription business for $1.6 billion,

- Acquired HRA Pharma for $1.8 billion,

- Settled a $1.6 billion Ireland tax assessment dispute for $0.27 billion, and

- Won a Belgium arbitration settlement for $0.36 billion.

On the other hand, there are areas of concern. The company:

- Endured lower cough and cold medicine sales when COVID-19 pandemic prevention activities across the U.S. severely reduced incidences of both viruses.

- Endured supply chain disruptions and higher costs lowering third quarter results, and

- Experienced an earnings per share decline to -$0.40 in the third quarter compared with $0.19 in the third quarter of 2020.

Investors who have followed Perrigo for several years remember when the company’s stock price was $20 in March 2009 and shot up to more than $190 per share in mid-2015. Today it is less than $40 now. They, along with potential investors, certainly hope company executives are correct in their current optimism.

SpartanNash Company

Grand Rapids-based SpartanNash was the worst performing stock in the Index in 2019, the second-best stock in 2020, and also the second-best stock in 2021 with a 48% increase in share price. How did it pull off two great years in a row after a terrible year in 2019? For starters, it began 2020 with a low bar due to its terrible performance in 2019. Then the pandemic hit. With restaurants either shut down or scaled back, and many people afraid to eat out in public, the stars aligned for grocery stores. Spartan sales increased 9-12% as people bought more grocery store products. Two good questions are what will happen when restaurant business returns to pre-pandemic levels and how long before that happens? When it does happen, SpartanNash’s sales and earnings are likely to regress at least a little.

Stryker Corporation

Kalamazoo-based Stryker is a major medical technology company. Like most companies, Stryker’s performance through the first three quarters of 2021 decreased sharply, decreasing approximately 30% compared with 2020. A significant part of Stryker’s revenue comes from joint replacement implants, and many of these surgeries were deferred during the pandemic. For the 12-month period ending September 30, 2021, earnings per share were $4.97, but the company projects full-year 2021 earnings per share will be slightly more than $9 per share. Investors remain optimistic. After all, Stryker’s stock price has increased five-fold over the past ten years, and the company doesn’t seem to be slowing down.

UFP Industries, Inc.

Grand Rapids-based UFP Industries designs, manufactures, and markets wood and wood substitute products. It has the distinction of finishing 2021 with the largest stock price increase–nearly 66%–out of the fifteen companies comprising the West Michigan Stock Index. Its price has increased steadily since 2013 when its stock price was $20, but more rapidly since December 2018 when the price was $27. It has more than tripled in the past three years.

Shortages of lumber alongside rising demand led to unprecedented, high lumber prices. During the third quarter, sales increased 41% and net income increased 57% compared with prior year results. Both are very good numbers but not when compared with second quarter performance when sales rose 117% and earnings increased 161%. Now you understand why UFP ended up at the top of the West Michigan Stock Index.

Whirlpool Corporation

Benton Harbor-based Whirlpool’s stock price increased $50 per share in 2021, a 30% increase. Consumers are flush with money, and they are spending like crazy, leading to high demand for household appliances. Its return on equity was 43%, an incredibly high number for any company, but especially for a company the size of Whirlpool. The company’s price/earnings ratio is only 7.4, an indication the stock is underpriced even at $230 per share. Accordingly, most stock analysts are bullish on Whirlpool, expecting further price increases. The company has announced earnings greater than consensus estimates for 13 consecutive quarters.

Wolverine World Wide, Inc.

Rockford, Michigan-based Wolverine World Wide, Inc. designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories. Its stock price fell almost 8% during the year, but that’s a little misleading. Its price hit $44 in early May, and then began falling as its earnings began falling. The major cause was temporary factory closings in Vietnam, a significant source of footwear manufacturing. They have reopened, but workers are reluctant to return to work, so that production is only 70% of normal. That has created major supply chain issues at a time when demand is strong. Company executives say there is incredibly strong demand for the fourth quarter. If supply chain issues are resolved, Wolverine’s stock price should see a strong surge.