How Have the Struggles of the Auto Industry Affected the West Michigan Economy?

By Gerry Simons, Ph.D., Professor, Department of Economics

The COVID-19 pandemic disrupted global supply chains including those of the auto industry, for which a shortage of semiconductor chips has had a devastating impact on production. In September 2021, the consulting firm AlixPartners forecast that the chip shortage would cost the global auto industry $210 billion in lost revenue in 2021 alone, with an expected loss of sales in 2021 of 7.7 million vehicles (AlixPartners, 2021). Additionally, IHS Markit forecast that the shortage in some types of automotive chips would likely continue into 2023 (IHS Markit, 2021). Shortages in automotive supplies are not limited to chips though. Global shortages have also arisen for rubber, petrochemicals, and magnesium (Fernandez, 2021, Hume, 2021, Wiseman & Krisher, 2021), which are all vital materials in the automobile manufacturing process. Closer to home, how is the auto industry faring in Michigan and West Michigan, and what has been the impact on the West Michigan economy?

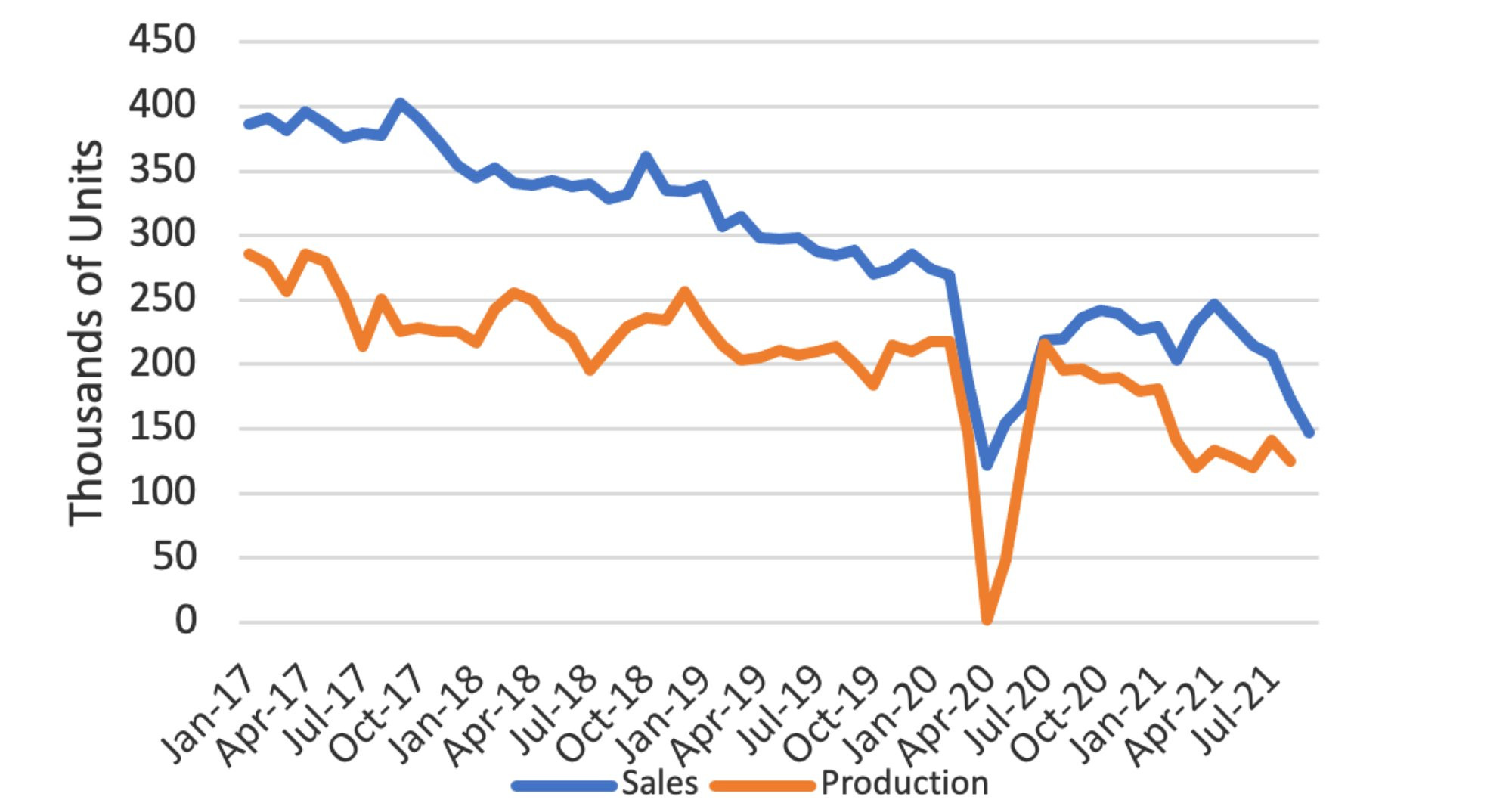

Figure 11 shows monthly domestic automobile production and retail sales for the U.S.2 since 2017. Automobile production in the U.S. has fallen dramatically in recent months, as Figure 1 shows. Monthly production rebounded to pre-pandemic levels in July 2020. However, only 84,200 vehicles were produced in September 2021, a 61% decline from the pre-pandemic production level in February 2020.

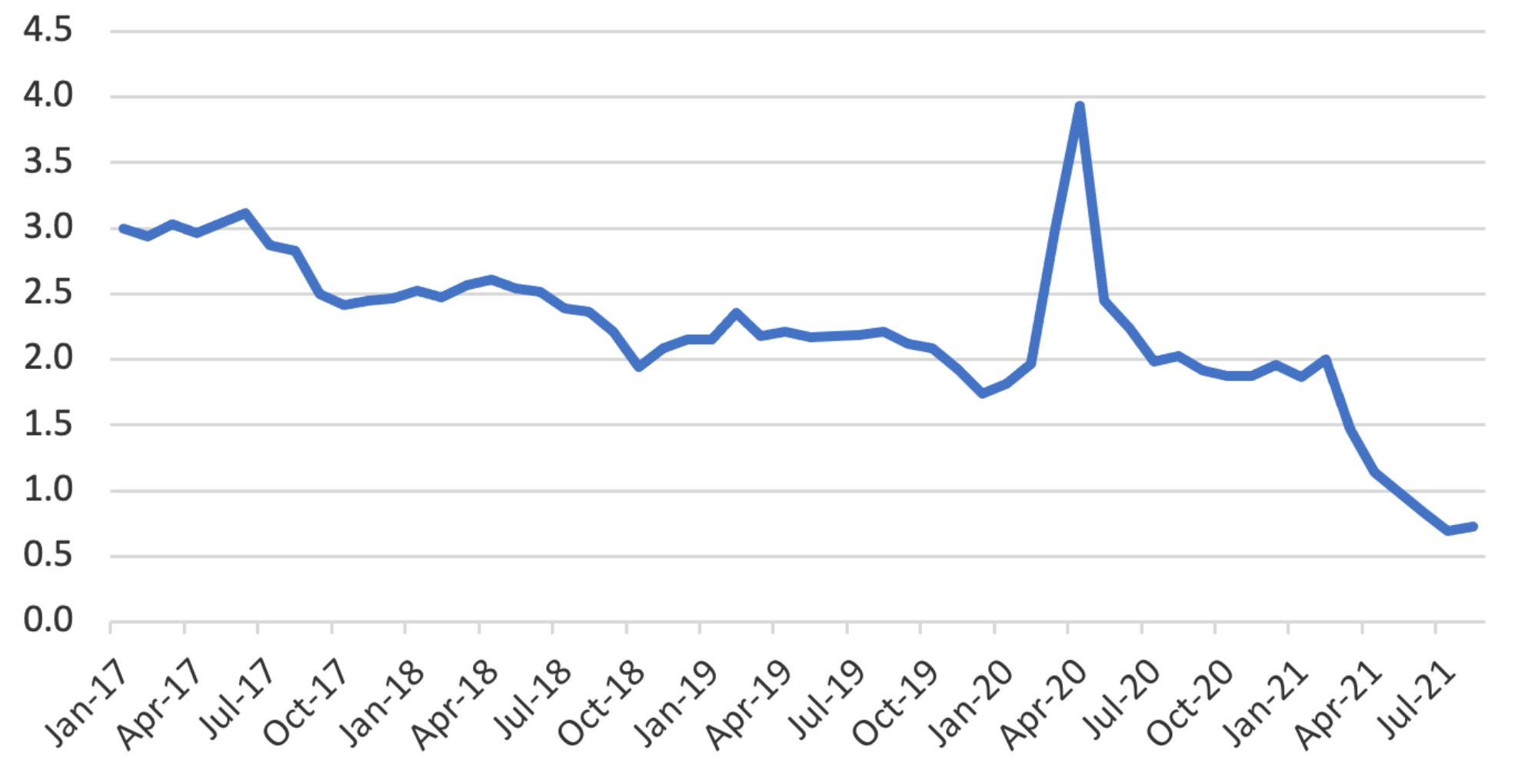

Following the easing of lockdown restrictions, domestic retail sales recovered to only around 82% of pre-pandemic levels and were 45% lower in September 2021 than in February 2020. The relationship over time between domestic production and sales can be more clearly seen in the monthly inventory-to-sales ratio shown in Figure 2. This ratio averaged 2.8 in 2017, jumped to 3.9 in April 2020 during the lockdown, and fell to 0.51 in September 2021.

So, at the national level, production is significantly below pre-pandemic levels, and there is very little inventory for sales. How might this affect our state and local economies?

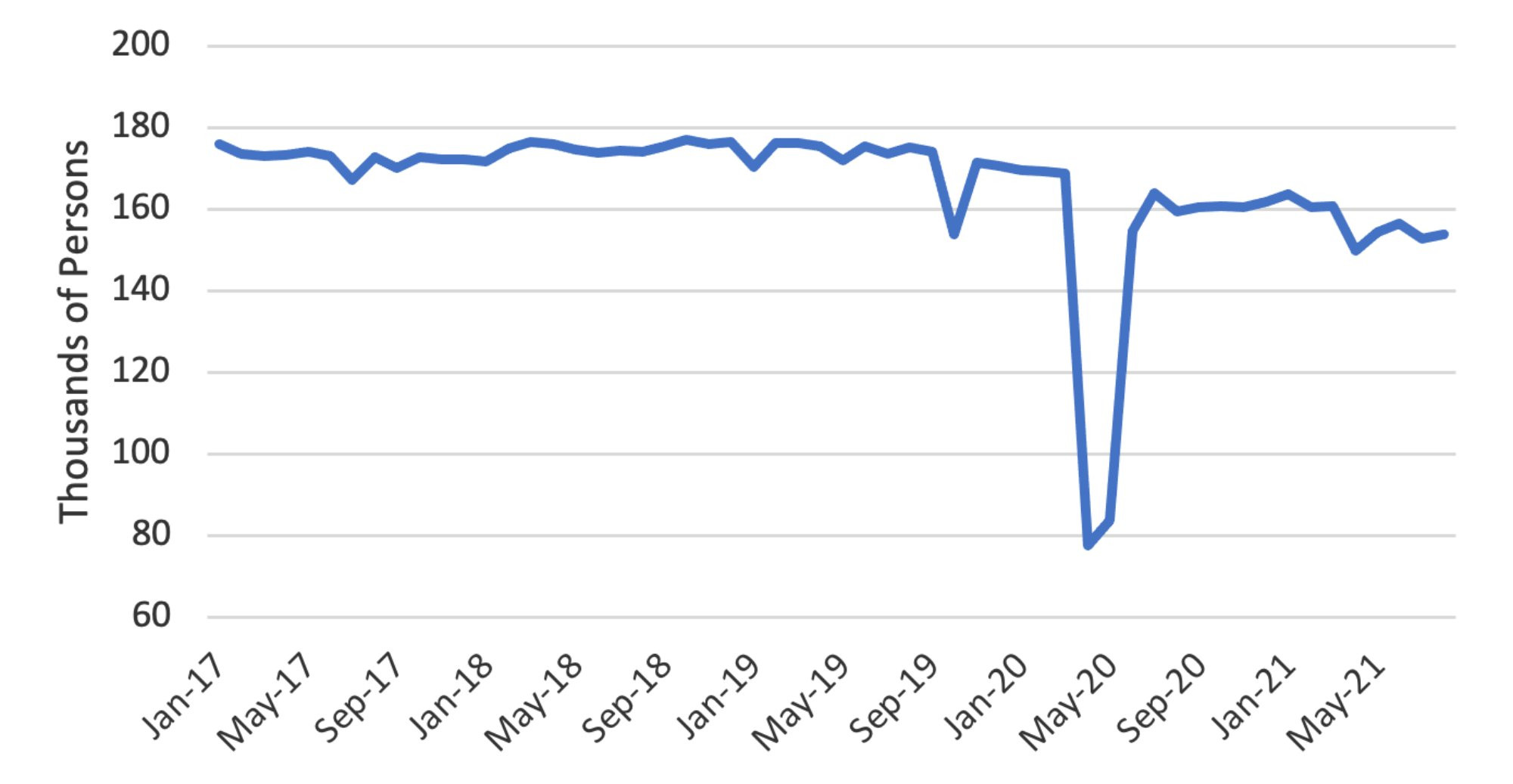

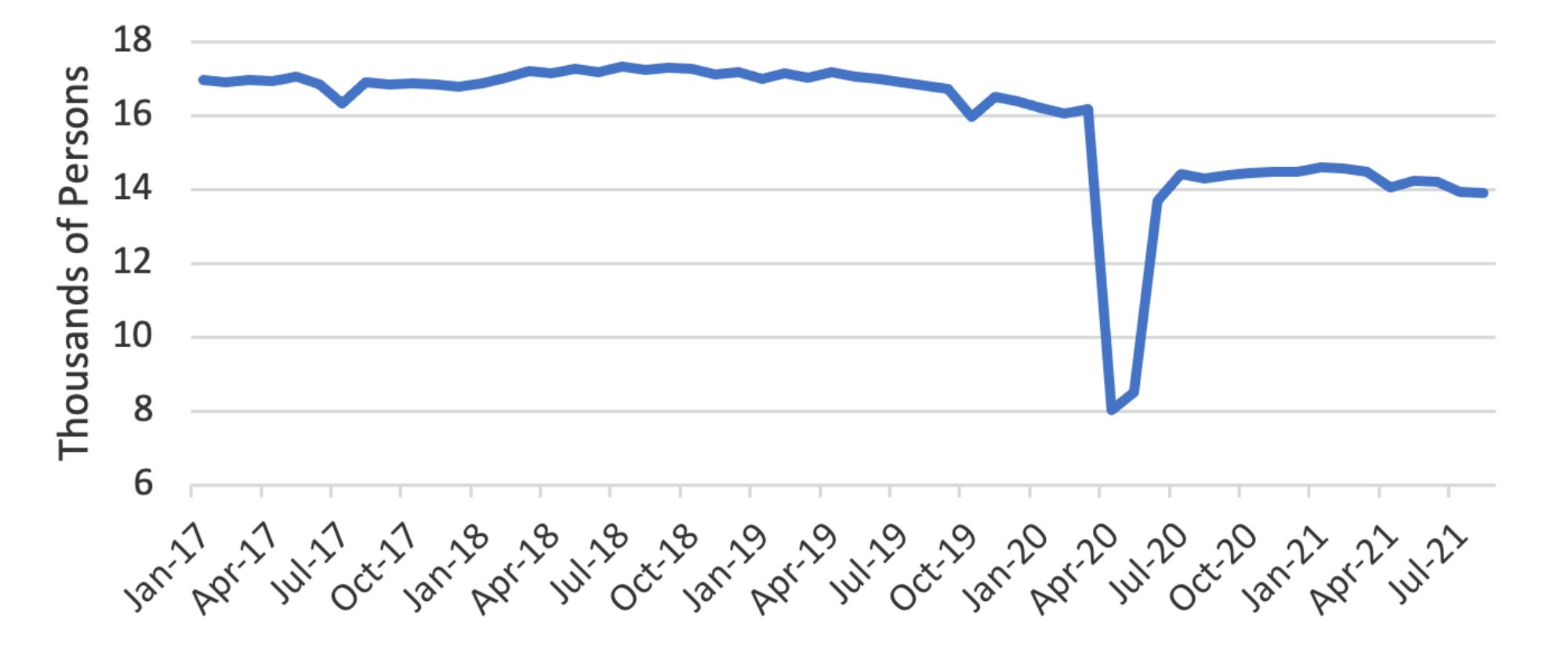

The Federal Government provides employment numbers in the auto industry at the state level, and employment numbers in “transportation equipment manufacturing” at the local level. For West Michigan, we can consider transportation equipment manufacturing to be a good proxy measurement for auto manufacturing. Figures 3 and 4 show these employment levels for Michigan and the Grand Rapids-Wyoming metropolitan statistical area3 (MSA), respectively. For Michigan as a whole, employment in the industry fell by approximately 8% from February 2020 to September 2021, representing a loss of approximately 14,000 jobs. What is not shown in Figure 3, though, is the impact on employment for vehicle vs. parts manufacturing. For the state as a whole, employment in auto parts manufacturing was hit the hardest – between February 2020 and September 2021 it fell by approximately 10% (a loss of 12,300 jobs), while employment in vehicle manufacturing fell by 5% (a loss of 1,700 jobs). For the Grand Rapids-Wyoming MSA, employment was down approximately 13% over the same period, reflecting that more of the auto industry employment in West Michigan is in parts manufacturing than in vehicle manufacturing. This amounts to a loss of approximately 2,130 jobs in auto manufacturing in the West Michigan area represented by the MSA. From January 2021 through September 2021, monthly employment in the West Michigan auto industry was 1,853 lower, on average, than in February 2020.

This loss of jobs in West Michigan gives us only a partial picture of the impact of the auto industry’s struggles on the regional economy. There is a knock-on or multiplier effect, as the impact of the decline in the auto industry works its way through the economy, creating indirect and induced effects. The Bureau of Economic Analysis has developed Regional Input-Output Modeling System (RIMS II) multipliers, which make it possible to estimate these indirect and induced effects.

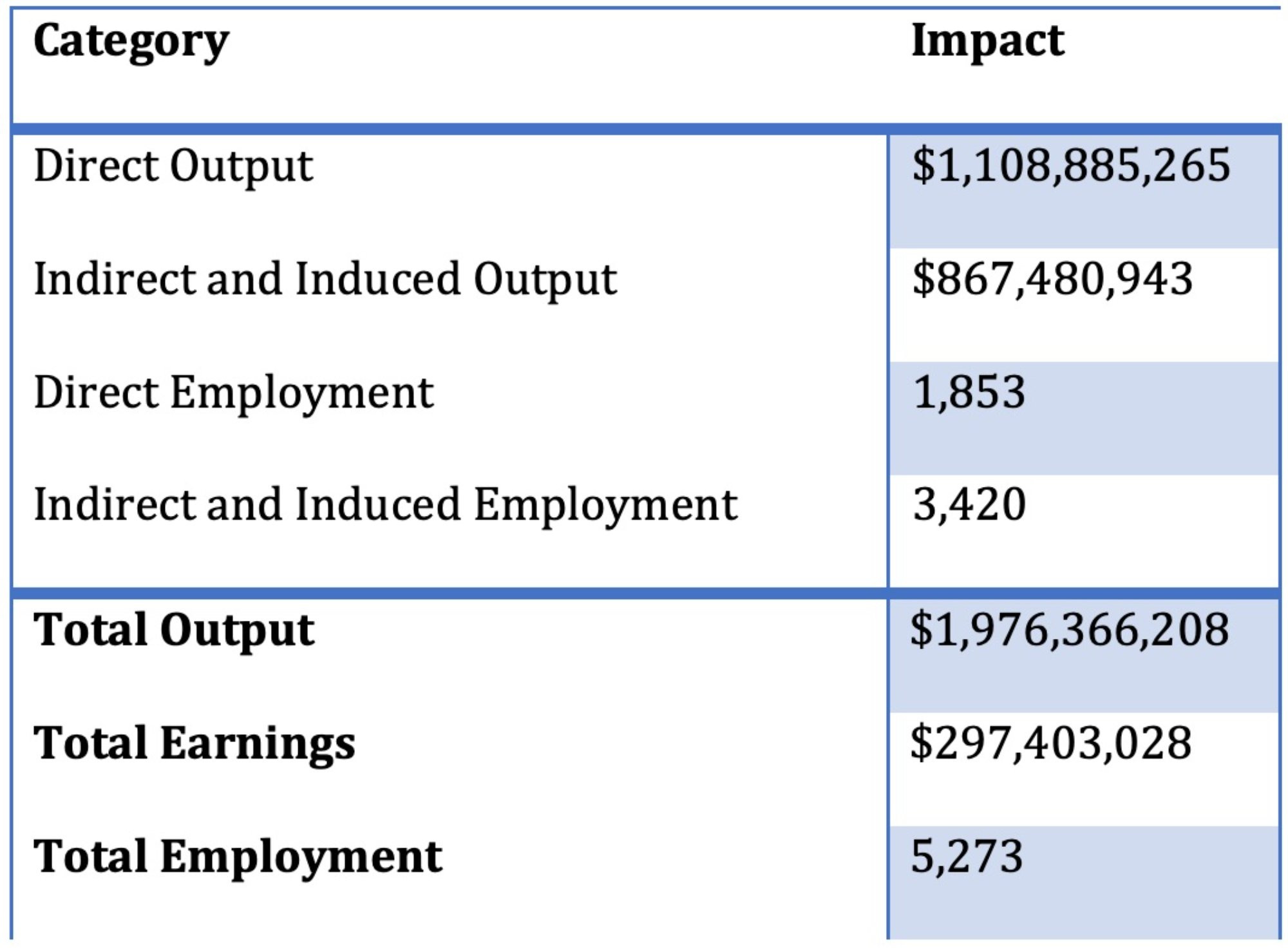

Taking that average number of 1,853 fewer jobs in the West Michigan auto industry in 2021 compared to before the pandemic, and using the appropriate RIMS II multipliers for auto industry construction, yields the impacts on the West Michigan economy shown in Table 1. These impacts give an estimate as to how much smaller the West Michigan economy is in 2021 compared to before the pandemic, due to the declines in the auto industry.

Taking that average number of 1,853 fewer jobs in the West Michigan auto industry in 2021 compared to before the pandemic, and using the appropriate RIMS II multipliers for auto industry construction, yields the impacts on the West Michigan economy shown in Table 1. These impacts give an estimate as to how much smaller the West Michigan economy is in 2021 compared to before the pandemic, due to the declines in the auto industry.

The “direct” categories measure the impact on West Michigan auto manufacturers themselves in 2021 – 1,853 fewer workers and $1.1 billion less in production compared to before the pandemic. The “indirect and induced” categories measure the impact that the decrease in production by those manufacturers has on other segments of the region’s economy. The indirect impacts arise because the reduction in activity by the auto manufacturing companies means that they will purchases fewer goods and services from other businesses – raw materials, cleaning services, etc. The induced effects come about because the loss of income from the direct and indirect impacts changes the spending patterns in the region – fewer people eating at restaurants and spending less at the mall, etc. The combined direct, indirect, and induced annual effects on the regional economy of the decline in auto manufacturing in the Grand Rapids- Wyoming MSA are shown in the last three rows of Table 1. These indicate that there is an estimated $2 billion in output, $297 million in earnings (wages, salaries, and proprietors’ income), and 5,273 in employment declines within the auto industry in the West Michigan economy comparted to pre-pandemic levels.

Of course, other factors have offset the above impacts – these estimates do not consider any severance packages or unemployment benefits received by those who lost their jobs; nor do they reflect displaced workers finding new employment in other sectors. However, these estimates do provide a starting point for evaluating to what extent the disruptions in the global auto industry have affected the West Michigan economy, and these data suggest the negative impact has been and continues to be significant.

References

AlixPartners. (2021, September 23). Shortages related to semiconductors to cost the auto industry $210 billion in revenues this year, says new AlixPartners forecast. https://www.alixpartners.com/media-center/press-releases/press-release-shortages-related-to-semiconductors-to-cost-the-auto-industry-210-billion-in-revenues-this-year-says-new-alixpartners-forecast/

Fernandez, C. (2021, October 8). Supply Chain Volatility in the Automobile Industry. Global Risks Insight. https://globalriskinsights.com/2021/10/supply-chain-volatility-in-the-automobile-industry/

Hume, N. (2021, October 19). China’s magnesium shortage threatens global car industry. Financial Times. https://www.ft.com/content/1611e936-08a5-4654-987e-664f50133a4b

IHS Markit. (2021, September 22). For Auto Makers, the Chip Famine Will Persist. https://news.ihsmarkit.com/prviewer/release_only/slug/2021-09-22-for-auto-makers-the-chip-famine-will-persist

Wiseman, P., & Krisher, T. (2021, September 30). From paints to plastics, a chemical shortage ignites prices. AP News. https://apnews.com/article/coronavirus-pandemic-technology-business-health-hurricanes-46bce9cc36dab2b330309dae0354cf53

Technical Notes

[1] All the data in the figures presented here are from the Federal Reserve Bank’s FRED database, which collates information from the Bureau of Economic Analysis (part of the U.S. Department of Commerce) and the Bureau of Labor Statistics (part of the U.S. Department of Labor) among others. The FRED database is available at http://fred.stlouisfed.org/

[2] The Federal data defines domestic production as all autos assembled in the U.S., but domestic sales are defined as sales in the U.S. of autos assembled in the U.S., Canada, and Mexico.

[3] In 2018, the Office of Management and Budget changed the definition of the Grand Rapids-Wyoming MSA (from Barry, Kent, Montcalm, and Ottawa counties to Ionia, Kent, Montcalm, and Ottawa counties) and renamed it the Grand Rapids-Kentwood MSA. However, the Bureau of Labor Statistics continues to use the earlier definition to make historical comparisons easier.